After taming inflation, the Fed aims for a soft landing

The market seems to have found a bottom in the previous quarter. There was a strong rally at the beginning of November which included a wide variety of sectors and industries. Small and medium cap stocks benefited the most (as reflected by the indices), which contrasts significantly with their lagging performance over the previous year, as well as the narrow rally of last spring involving the tech giants. The businesses underlying small and medium stocks tend to be more sensitive to interest rates. We focus on these kinds of stocks and believe they provide great opportunities and value.

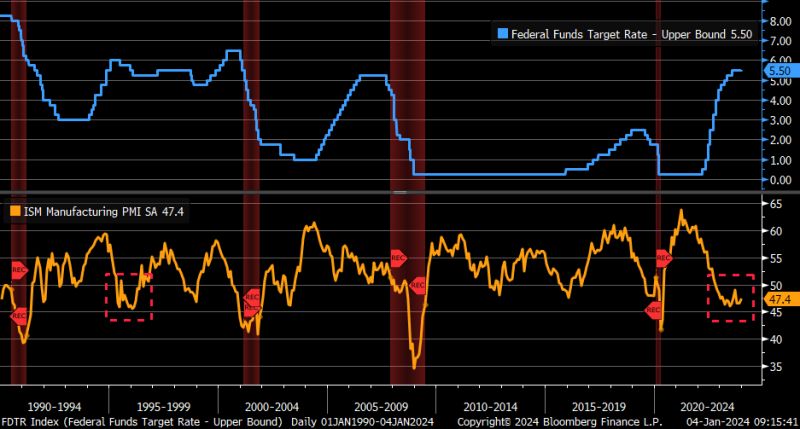

The long-expected recession still hasn’t arrived. The potential for weakness has caught the Federal Reserve’’s attention, however. In their December statement, the Fed indicated that they are anticipating 3 interest rate cuts toward the end of 2024. While the economy may remain healthy today, it’s worth remembering that rate cuts occur in response to an economic slowdown. A “soft landing” is the term given to a situation where the Fed manages to avoid a recession by acting right on time. These are rare, and the previous one occurred in 1995. (See chart below). The Fed is commonly perceived to react too late both to inflation and recession.

Looking ahead, we’re optimistic about the market. Just because the Fed sees the possibility for a slowdown, doesn’t mean it would occur soon. Additionally, there are some potential supports for the economy, which might help achieve a soft landing. These include pent-up housing demand and a wave of productivity gains from new technologies. There are of course risks to this scenario (including geopolitical risks), and we will continue to monitor new developments.

ISM Manufacturing PMI is a measure of economic output

Recessions are shaded in red

Active Manager Sentiment

December 27, 2024: 102.71% Aggregate Equity Exposure

Equity exposure among contributing active mangers ended the year extremely strong at over 100% (in aggregate). We read this as a signal that the market has found a durable bottom over the previous quarter as NAAIM members have swung exposure up from a low of under 25% in October.

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members. NAAIM member firms are asked each Wednesday to provide a number which represents their overall equity exposure at the market close. Responses are tallied and averaged to provide the average long (or short) position of all NAAIM managers, as a group.

Disclosure: Magnifina is a frequent contributor to this index.

Stock Performance by Category

The NASDAQ 100 is the big winner in 2023 as enthusiasm about AI continues to benefit the megacap tech companies. These few companies represent an outsize share of US stock valuation and tend to skew indices with few stocks, such as the NASDAQ 100 or DOW 30.