In a series of articles, we’ve been exploring the potential of artificial intelligence, specifically ChatGPT, to deliver sound financial advice. So far, the subject has always been IRAs – comparing Traditional vs. Roth. Despite some initial hiccups, our AI tests have shown promising evolution over time. This is an example of what AI is truly capable of and what it might hold for the future.

In each installment, we consistently ask two questions. First, an explanation of the difference between Traditional and Roth IRAs. Second, a more nuanced inquiry. It requires not only understanding of these accounts but also an ability to navigate contradictions. We ask which type of IRA would be better for client with complex needs.

Understanding IRAs: The Basics

I am a financial planner who is advising a client about whether to open a Traditional IRA or Roth IRA. Can you help me write a simple explanation about the differences between these kinds of accounts? Please make it easy to understand for someone who isn't a financial expert.

Subject: Understanding Traditional IRA vs. Roth IRA: A Simple Guide

Dear [Client's Name],

As your financial planner, I wanted to provide a simple explanation of the differences between Traditional and Roth IRAs. Both of these Individual Retirement Accounts (IRAs) are designed to help you save for retirement, but they have different tax implications that might make one more suitable for your needs than the other.

Traditional IRA:

- Pre-tax contributions: The money you contribute to a Traditional IRA comes from your pre-tax income, meaning you don't pay taxes on it when you contribute. This can lower your taxable income for the year and potentially reduce your tax bill.

- Tax-deferred growth: The investments in your Traditional IRA will grow tax-deferred, meaning you won't pay taxes on the earnings until you withdraw them in retirement.

- Taxable withdrawals: When you withdraw money from your Traditional IRA in retirement, the withdrawals are treated as ordinary income and taxed accordingly.

- Required Minimum Distributions (RMDs): Starting at age 72, you'll be required to take minimum distributions from your Traditional IRA each year, which will be subject to taxes.

Roth IRA:

- After-tax contributions: The money you contribute to a Roth IRA comes from your after-tax income, meaning you've already paid taxes on it. There is no immediate tax benefit for contributing to a Roth IRA.

- Tax-free growth: The investments in your Roth IRA will grow tax-free, meaning you won't pay taxes on the earnings as long as you follow the withdrawal rules.

- Tax-free withdrawals: Qualified withdrawals from your Roth IRA in retirement are tax-free, allowing you to keep all the money you've saved and earned.

- No Required Minimum Distributions (RMDs): You're not required to take minimum distributions from your Roth IRA during your lifetime, allowing your money to continue growing tax-free.

Which IRA is best for you depends on your current tax situation and your expected tax situation in retirement. If you think you'll be in a higher tax bracket when you retire, a Roth IRA may be more beneficial. If you think your tax bracket will be lower in retirement, a Traditional IRA could be a better fit.

Please let me know if you have any questions or if you'd like to discuss this topic further. I'm here to help you make the best decision for your financial future.

Best regards,

[Your Name] Financial Planner

In previous testing, the AI was able to differentiate between these two types of IRAs adequately. It grasped the essential difference that contributions to Traditional IRAs can be tax-deductible, while retirement withdrawals are taxed as income. In contrast, contributions to Roth IRAs are made with post-tax dollars, meaning that withdrawals in retirement are typically tax-free (provided certain conditions are met).

Contradictions and Complications

The true test of AI’s proficiency, however, came in the second question. The scenario was intentionally embedded with contradictions.

My client is 30 years old, expects to be in a higher tax bracket, but would prefer a current tax deduction. Which account would you recommend, or do you need more information?

Based on the information provided, your client prefers a current tax deduction and expects to be in a higher tax bracket during retirement. This presents a trade-off between the immediate tax benefit of a Traditional IRA and the potential long-term tax benefits of a Roth IRA.

If the current tax deduction is a high priority for your client, a Traditional IRA might be the better choice. This will allow them to reduce their taxable income now, providing an immediate tax benefit. However, they should be aware that withdrawals will be taxed as ordinary income during retirement, which could be less advantageous if they are indeed in a higher tax bracket at that time.

On the other hand, if your client is willing to forego the immediate tax deduction in favor of potentially greater long-term tax benefits, a Roth IRA might be more suitable. While contributions are made with after-tax dollars, the tax-free growth and tax-free withdrawals during retirement can be valuable, especially if they end up in a higher tax bracket.

It may be useful to gather more information about your client's financial goals, projected income, and expenses during retirement to make a more informed recommendation. Additionally, you could discuss the possibility of contributing to both types of accounts (if eligible), which would allow for a more diversified tax strategy.

Please feel free to reach out if you need any further assistance or clarification.

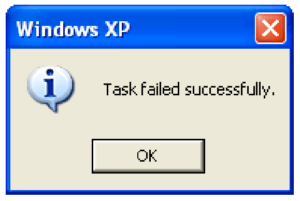

Initially, ChatGPT struggled with this question. It was prone to overlooking the inherent contradiction in the client’s needs. It offered recommendations that were inconsistent or unsuitable. However, in this latest installment, the AI displayed significant improvement. It was able to correctly identify and acknowledge the contradiction in the client’s situation before proceeding without a firm recommendation. It failed successfully.

Personalization and Progress

What seems to have made a difference in this latest iteration was the use of more personalized language. By making the conversation more context-specific, ChatGPT was able to perform a deeper analysis of the situation. It provided more nuanced and accurate advice.

Artificial intelligence, and ChatGPT in particular, is a technology in evolution. It’s on a journey of learning and refinement, much like us humans. The difference in its performance from the first article to now is testament to this evolution.

While AI’s current ability to handle complex financial advice scenarios may be limited, this progress is promising! In time, we may witness AI providing with sound advice for complex financial decisions. However, as it stands, professional human advice, with our understanding of complexities and contradictions, remains indispensable.

In the coming articles, we will continue to test ChatGPT’s financial advice capabilities. Its progress so far has been fascinating! We look forward to sharing more insights with you as we further explore this intriguing intersection of artificial intelligence and financial advice.