Congratulations! You’ve hit the jackpot of the corporate world – Restricted Stock Units (RSUs). As part of your compensation package, you’re not just getting a paycheck; you’re getting a piece of the company pie. While the ultimate value of that share remains uncertain, the potential for substantial wealth is real and exciting. You could be sitting on a goldmine, especially if you’re an early employee in a high-growth company.

As you embark on investing with RSUs, you’ll find that they present both unique opportunities and challenges for your overall financial strategy. This article will guide you through the key considerations for investing when you have RSUs, helping you make informed decisions to optimize your financial future.

RSU Fundamentals

Restricted Stock Units (RSUs) are a form of equity compensation used by companies to reward and retain employees. An RSU is a promise from your company to give you a number of shares of stock in the future. These shares “vest” over time, following a schedule set by your company.

RSUs differ from other forms of equity compensation:

- Stock Options: With options, you have the right to buy shares at a predetermined price. RSUs convert directly into shares upon vesting.

- Employee Stock Purchase Plans (ESPPs): These allow you to buy company stock at a discount. RSUs grants don’t require a purchase.

- Restricted Stock: While similar to RSUs, restricted stock is issued immediately, with restrictions on selling until vesting. RSUs aren’t issued until they vest.

The value of your RSUs depends on your company’s stock price. As the stock price rises, so does the value of your RSUs, aligning your financial success with the company’s performance.

Understanding these basics is crucial as you consider how to invest with RSUs as part of your overall portfolio. As your RSUs vest and join the rest of your investments, you’ll need to make important decisions about holding, selling, and balancing these assets.

Market Risks of RSU Concentration

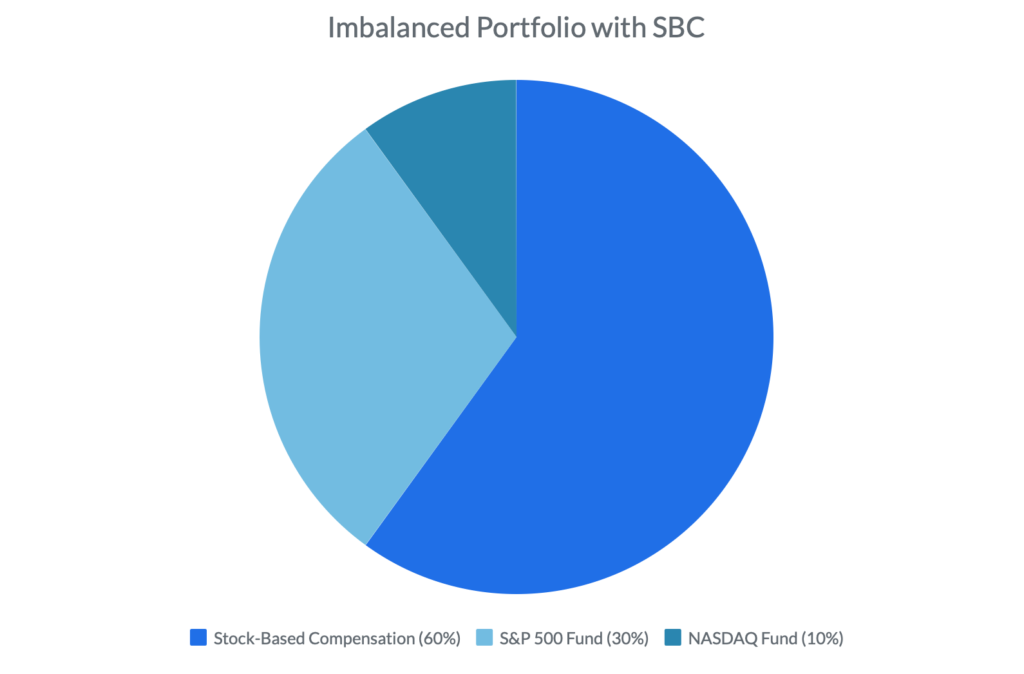

Concentration risk occurs when a significant portion of your wealth is tied to a single company’s stock. With RSUs, you’re essentially doubling down on your company – not only is your income dependent on its success, but so is a substantial part of your investment portfolio.

This concentration can amplify both positive and negative outcomes. If your company thrives, your RSUs could significantly boost your wealth. However, if your company struggles or its stock price drops, both your income and your investments could be at risk simultaneously. Remember Enron? Many employees had most of their retirement savings in company stock. When Enron collapsed, they lost both their jobs and their life savings.

Mitigating these risks often involves careful portfolio diversification, but the right approach varies based on individual circumstances. Given the complexities of managing concentration risk for long-term financial stability, many individuals benefit from working with financial professionals who can provide personalized strategies for investing with RSUs.

Tax Considerations for RSUs

RSUs typically have tax consequences at two main points: when they vest and when you sell the shares.

When your RSUs vest, they’re generally treated as ordinary income. This means the value of the shares at vesting is considered part of your taxable income for that year, even if you don’t sell the shares immediately.

If you hold onto the shares after vesting and they increase in value, you may have capital gains to consider when you eventually sell. The tax treatment of these gains can differ based on how long you’ve held the shares.

For investors with sufficient assets and foresight, there may be opportunities to plan for these tax events before RSUs vest. By anticipating future vesting dates, some investors work with their advisors to position their overall portfolio in ways that could potentially mitigate tax impacts. However, such strategies require careful planning and must comply with all applicable tax rules.

Given the complexity of tax laws and the potential impact on your overall financial situation, many people find it beneficial to work with tax professionals and investment advisors. These experts can provide personalized guidance based on your specific circumstances and help develop strategies aligned with your financial goals.

Constructing a Balanced Portfolio with RSUs

Investing with RSUs requires careful consideration of how they fit into your overall investment portfolio. The key concept is diversification. While it’s natural to have confidence in your company, having too much of your wealth tied to a single stock can be risky. As your RSUs vest, think about how they fit into your broader financial picture.

Your approach to managing RSUs in your portfolio should align with your personal financial goals and risk tolerance. Some investors choose to hold their shares, betting on their company’s long-term growth. Others may sell some or all of their shares upon vesting to reinvest in a more diversified manner. Forward-thinking investors might even consider strategies that prepare their portfolio for upcoming vesting events.

There’s no one-size-fits-all strategy. Your decisions should take into account your overall financial situation, including your other investments, savings, and future goals.

Given the complexity of integrating RSUs into a well-balanced portfolio, many investors find value in seeking professional financial advice. An advisor can help develop a personalized strategy that optimizes your RSUs within the context of your broader financial plan.

Our Approach to Investing with RSUs: Quantitative Indexing

At Magnifina, we recognize the unique challenges and opportunities that come with RSU compensation. To address these, we utilize an advanced approach called Quantitative Indexing. We designed it to optimize RSU concentration risk within a broader financial strategy.

Our Quantitative Indexing approach is a data-driven method that aims to balance the potential of your company stock with the benefits of diversification. Here’s how we apply this strategy to RSU management:

- Personalized Analysis: We start by understanding your unique RSU situation, overall financial goals, and risk tolerance.

- Custom Index Creation: Using advanced algorithms, we create a personalized index that complements your RSU holdings. This allows you to maintain strategic exposure to your company’s stock while diversifying across other securities.

- Risk Management: We tailored our approach to manage concentration risk, helping to protect your wealth while still capitalizing on your company’s potential growth.

- Tax Efficiency: We implement strategies designed to optimize tax outcomes, considering both the immediate tax implications of vesting RSUs and long-term capital gains considerations.

- Dynamic Rebalancing: As market conditions change and your RSUs vest, we systematically rebalance your portfolio to maintain your desired level of diversification and risk exposure.

- Holistic Integration: We don’t just manage your RSUs in isolation. Our approach integrates RSU management into your broader financial plan, including retirement planning and other long-term financial goals.

- Ongoing Expertise and Support: Our team stays up-to-date with the latest in equity compensation trends and tax laws. We provide continuous support, adjusting strategies as your financial situation evolves and as market conditions change.

If you’re interested in learning more about how our Quantitative Indexing approach works, we invite you to schedule a consultation. We’ll be happy to discuss your specific situation and how our professional guidance can help you optimize your RSU strategy.

Conclusion

RSUs can significantly boost your wealth, but they require careful management. Throughout this article, we’ve explored the key aspects of investing with RSUs – from their basic structure to risk management, tax implications, and portfolio integration.

Here are the main points to remember:

- RSUs are a unique form of equity compensation, distinct from stock options or purchase plans.

- While RSUs can be valuable, they also introduce concentration risk. Consider diversification strategies to protect your overall wealth.

- Understand the tax implications of your RSUs. Plan ahead, potentially even before vesting, to manage your tax burden effectively.

- When building your portfolio, think critically about how your RSUs fit into your broader financial picture and long-term goals.

- For those seeking a data-driven approach, strategies like Quantitative Indexing offer sophisticated methods for RSU management.

There’s no universal strategy for managing RSUs, which is why at Magnifina, we tailor our approach to your individual financial situation, goals, and risk tolerance. While this guide provides a foundation, the intricacies of RSU management often benefit from our expert guidance. We encourage you to take action on optimizing your RSU strategy by reaching out to us for a complimentary consultation. By leveraging our expertise, you can approach your RSUs with knowledge and strategy, maximizing this valuable form of compensation and achieving your financial goals.