Predicting interest rates is a daunting task, even for the most experienced economists and financial analysts. Traditional tools, such as the yield curve, have proven to be flawed and unreliable. However, there’s a surprising set of factors that can help us forecast interest rates more accurately: demographics. In this article, we’ll explore how demographic relate to inflation, which in turn predicts interest rates, and what this means for investors and the economy in 2025.

The Yield Curve: A Flawed Forecasting Tool

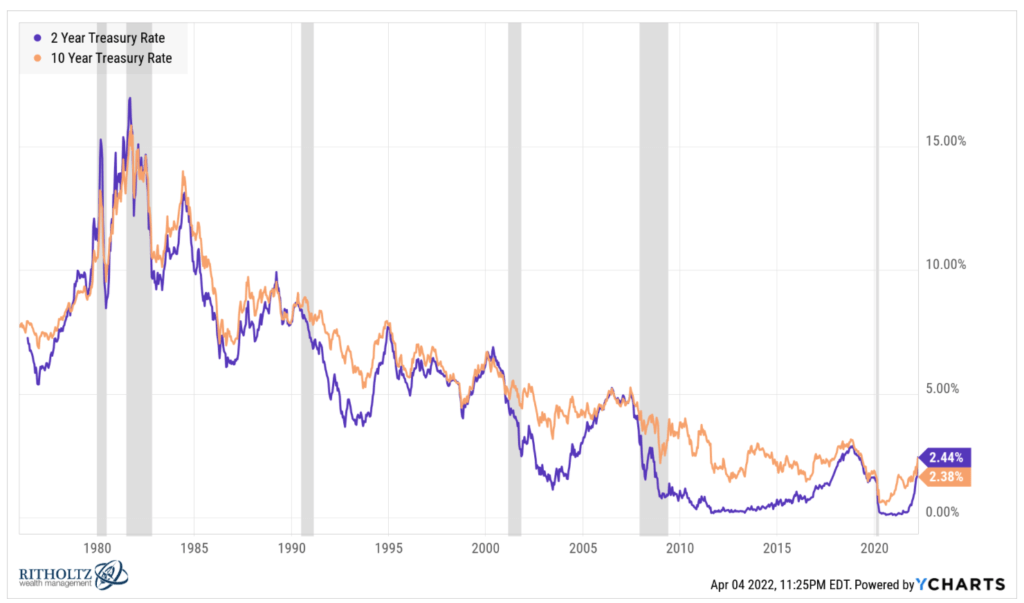

The yield curve, which plots interest rates of bonds with different maturities, is often used to forecast interest rates. When the yield curve inverts, meaning short-term rates are higher than long-term rates, it’s generally seen as a sign that interest rates will fall in the future. However, the yield curve has limitations and has been wrong in the past. It doesn’t account for other crucial factors that influence interest rates, such as demographics.

The chart illustrates a strong correlation between the 2-year and 10-year Treasury yields, demonstrating that the current 10-year rate is not a reliable predictor of future short-term rates

Demographic Factors and Inflation

Demographics play a significant role in determining inflation, which in turn affects various interest rates. As the population grows and ages, it influences the demand for goods and services, as well as the labor supply. These shifts in demand and supply can lead to changes in prices and wages, ultimately impacting inflation.

Inflation affects interest rates through two main channels. First, the Federal Reserve, which sets short-term interest rates, closely monitors inflation and adjusts rates to keep it under control. When inflation rises above the Fed’s target (usually 2%), the central bank may raise short-term rates to cool the economy. Second, market participants demand higher interest rates on longer-term bonds to compensate for the expected loss of purchasing power due to inflation.

Therefore, accurately predicting inflation is crucial for forecasting both short-term and long-term interest rates. This is where demographic factors come into play, as they can provide valuable insights into future inflation trends. Let’s take a closer look at three key demographic factors that predict inflation and interest rates:

Prime Leverage Age Population

The prime leverage year population refers to the age group most likely to borrow money for major purchases, such as homes and cars. In the United States, this is typically the 25-54 age group. When this population is large relative to other age groups, it can lead to increased demand for loans, driving up interest rates. Conversely, when the prime leverage year population is smaller, it can result in lower interest rates. Historical data shows a strong correlation between the prime leverage year population and CPI growth. As millennials enter their prime leverage years, this factor points to potential upward pressure on inflation and interest rates.

Labor Force Growth

Labor force growth is another important demographic factor that influences interest rates. When the labor force is growing quickly, it can lead to wage growth and increased consumer spending, which can drive up inflation. On the other hand, slower labor force growth can result in lower inflation and interest rates. There’s a clear correlation between labor force growth and 10-year Treasury rates. With millennials entering the workforce in large numbers, labor force growth is expected to accelerate, suggesting higher inflation and interest rates may follow.

Lagged Birthrate

Surprisingly, even birthrates from 25 years ago can impact current inflation and interest rates. A higher birthrate 25 years ago means a larger population entering the workforce and prime leverage years today. This increased demand for goods, services, and loans can drive up inflation and interest rates. Conversely, a lower birthrate 25 years ago can lead to lower inflation and interest rates today. The data shows a strong correlation between the 25-year lagged birthrate and 10-year average inflation.

However, it’s important to note that this factor doesn’t account for immigration, which can also significantly impact labor force growth and demand. Therefore, the lagged birthrate may not necessarily indicate higher inflation and rates, and it’s crucial to consider a range of potential outcomes.

Implications for Investors and the Economy

The demographic factors discussed above suggest that the U.S. economy may be shifting into a new regime characterized by higher inflation and interest rates compared to the previous 10-15 year baseline. As millennials enter their prime earning and borrowing years, their influence is expected to create a different economic environment than what many investors have grown accustomed to. This shift presents both opportunities and challenges, and investors may need to adjust their strategies accordingly.

Given the potential for higher growth, inflation, and interest rates, consider the following implications:

- Equities vs. bonds: In higher growth and rising rate environments, stocks have historically outperformed fixed income. Sectors that are sensitive to consumer spending and economic growth may be more favored.

- Equity style and sectors: Value and cyclical stocks in sectors like financials, industrials, energy, and consumer discretionary have tended to perform well during inflationary periods with strong economic growth. High valuation growth stocks may face headwinds from rising rates.

- Bond duration and type: Shorter maturity bonds reduce interest rate risk when rates are rising. Floating rate and inflation-protected securities can provide some defense against rising rates and inflation.

- Real assets: Real estate has historically provided some inflation protection since property values and cash flows have tended to rise with the overall price level.

- Alternative investments: Private markets may offer opportunities to capitalize on strong economic growth and diversify portfolios, but come with unique risks and considerations.

- Geographic diversification: Millennials are a global demographic, suggesting that both developed and emerging equity markets may experience tailwinds from this cohort.

- Active vs passive: More volatile, rapidly changing economic regimes have historically presented opportunities for skilled active managers to add value through security selection and risk management.

The key is positioning portfolios to benefit from the demographic tailwinds and strong growth, while defending against the potential headwinds of higher inflation and interest rates. A diversified, balanced approach, with an emphasis on equities, short duration, real assets, alternatives and international, is likely optimal for this environment.

Conclusion: Demographic Data Informs Interest Rate Predictions

Predicting interest rates is a complex task, but demographic factors offer a valuable and often overlooked tool for forecasting. By examining trends in the prime leverage year population, labor force growth, and lagged birthrates, we can gain insight into future inflation and interest rates. As we look ahead to 2025, considering these demographic factors will be essential for investors and policymakers alike. By staying attuned to these trends, we can navigate the ever-changing financial landscape with greater confidence and success.

At Magnifina, we understand the importance of considering these factors when making investment decisions and providing financial advice to our clients. As your trusted partner, we are here to help you navigate this shifting economic landscape. Our team of experienced professionals closely monitors these demographic trends and their impact on your financial well-being, ensuring that your investment strategy is well-positioned to take advantage of the opportunities and manage the risks that lie ahead.