The usual suspects are driving this market higher

The major stock market indices rose over the past quarter due mostly to only a handful of technology stocks. Nvidia accounted for about 33% of the gain in the S&P 500 year to date. Adding in Microsoft, Amazon, Meta, and Eli Lilly, accounts for 55% of the year’s gain.

Even more astonishingly, only three stocks, Microsoft, Apple, and Nvidia, make up 21% of the S&P 500 index! The top 10 stocks account for 36% of it. This condition presents a conundrum for traditional investment managers. A principal tenet of risk management is diversification, and it is imprudent to allocate one third of a portfolio to just 10 highly correlated stocks.

Clearly AI is a technology with highly promising business applications. This year, nearly 40% of the companies in the S&P 500 mentioned AI to stock analysts in conference calls, compared with about 10% two years ago. However, it’s still very early in this technology cycle, and how it will progress remains highly uncertain. We are reminded of the 2000 Dot Com Internet bubble. While investors knew how influential the Internet would be, most of the top stocks at the time ultimately weren’t the ones that would benefit most. Indeed, Google and Facebook weren’t even tradeable back in 2000.

Top technology stocks by market cap in 2000:

- Microsoft, $492 billion

- Cisco Systems, $454 billion

- Intel, $392 billion

- Oracle, $217 billion

- Lucent, $214 billion

Top stocks by market cap in 2020:

- Microsoft, $1.200 trillion

- Apple, $1.112 trillion

- Amazon, $971 billion

- Alphabet/Google, $799 billion

- Facebook, $475 billion

Apart from AI, there was one anomaly in Q2 worth examining. The Utilities sector performed second best and very nearly outperformed Technology (see first graph below). Utilities are known to be very safe and stable investments, which provide a consistent dividend. Significant price swings are unusual, and we are considering three possibilities: 1) AI is expected to use a lot of energy, and the market is correctly pricing this in. 2) Utilities are in a speculative bubble due to AI energy usage hype. 3) Active investors are concerned about market valuations and are rotating into safer sectors in anticipation of upcoming volatility.

All in all, we remain committed to investing based on value and credible opportunity. We are avoiding hype and speculation, opting to search for investments in more subtle industries. And as always, we are monitoring potential risks out on the horizon.

Active Manager Sentiment

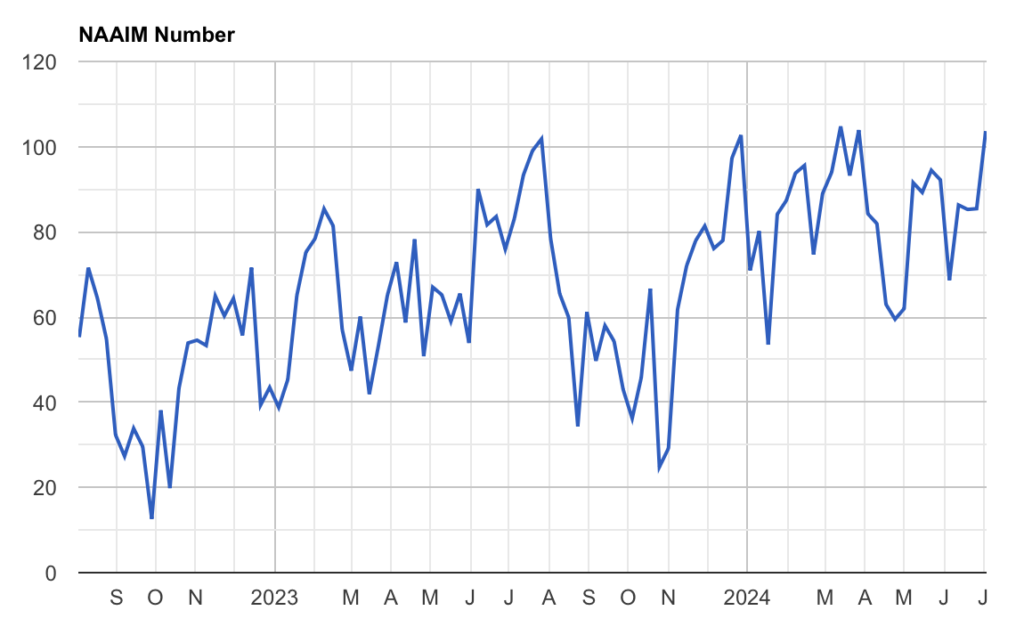

July 4, 2024: 103.66% Aggregate Equity Exposure

NAAIM member equity exposure is back above 100%, as active managers are building leveraged positions. We read this as a signal that the market is healthy, but are watching closely for a sudden shift.

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members. NAAIM member firms are asked each Wednesday to provide a number which represents their overall equity exposure at the market close. Responses are tallied and averaged to provide the average long (or short) position of all NAAIM managers, as a group.

Disclosure: Magnifina is a frequent contributor to this index.

Stock Performance by Category

The technology and communication services indices remain heavily skewed by the 7 megacap companies. AAPL and MSFT represent over 40% of technology, and META and GOOG are over 40% of communications services.

The NASDAQ 100 is the big winner over the past year as enthusiasm about AI continues to benefit the megacap tech companies. These few companies represent an outsize share of US stock valuation and tend to skew indices.