Inflation is a persistent economic force that erodes the purchasing power of money over time. As prices rise, investors seek ways to protect their wealth and maintain its value. While many turn to traditional inflation hedges like gold or real estate, stocks offer a compelling long-term solution for combating the effects of inflation. This article explores how stocks serve as an effective hedge and are one of the best investments for inflation.

Common Myths About Stocks and Inflation

When it comes to stocks and inflation, several persistent myths can mislead investors. Let’s clear the air on some of these misconceptions:

“Stocks Always Perform Poorly During High Inflation”

Many investors believe stocks inevitably suffer during high inflation, often citing the challenging 1970s as evidence. However, this view is oversimplified. During that decade of rampant inflation, stocks nearly kept pace with rising prices – the hallmark of an effective hedge. While not delivering spectacular returns, they preserved value in difficult conditions. Moreover, in many other inflationary periods, stocks have not just kept up with inflation but outperformed it, often significantly. This long-term track record highlights stocks’ potential as one of the best investments for inflation, especially over extended time horizons.

“All Stocks Perform Equally during Inflation”

Companies with strong market positions, pricing power, and efficient operations tend to weather inflationary storms better than their weaker counterparts. Consumer staples companies with beloved brands, for instance, can often pass increased costs onto consumers without significantly impacting demand, while companies in highly competitive industries may see their profit margins squeezed.

“Bonds Are Safer Than Stocks During Inflation”

While certain bonds, like Treasury Inflation-Protected Securities (TIPS), are designed to keep pace with inflation, many bonds—especially those with fixed interest rates—can lose real value as inflation erodes their purchasing power. High-quality stocks, particularly those that consistently grow their dividends, can offer better inflation protection than many bonds. Dividend stocks provide potential for both capital appreciation and income growth that can outpace inflation over time. This is why stocks are often considered one of the best investments for inflation compared to many fixed-income securities.

Inflation’s Double Edge: Short-Term Volatility and Long-Term Growth

Stocks exhibit different behaviors in relation to inflation depending on the time horizon we consider. Understanding this dual nature is key to leveraging stocks effectively as an inflation hedge.

Short-Term Volatility

In the immediate aftermath of inflation news or during periods of rapidly rising prices, stock markets often experience volatility. Several factors contribute to this short-term turbulence:

- Profit Margin Pressure: Higher costs can squeeze companies’ profit margins, especially if they can’t immediately pass these increases on to consumers.

- Interest Rate Sensitivity: Central banks often raise interest rates to combat inflation, making bonds relatively more attractive and potentially leading to stock sell-offs.

- Consumer Spending Shifts: As people adjust their budgets to higher prices, discretionary spending may decrease, affecting certain sectors more than others.

These factors can lead to temporary stock market declines or increased volatility. However, this short-term pain doesn’t negate the long-term benefits of stock ownership during inflationary periods.

Long-Term Growth

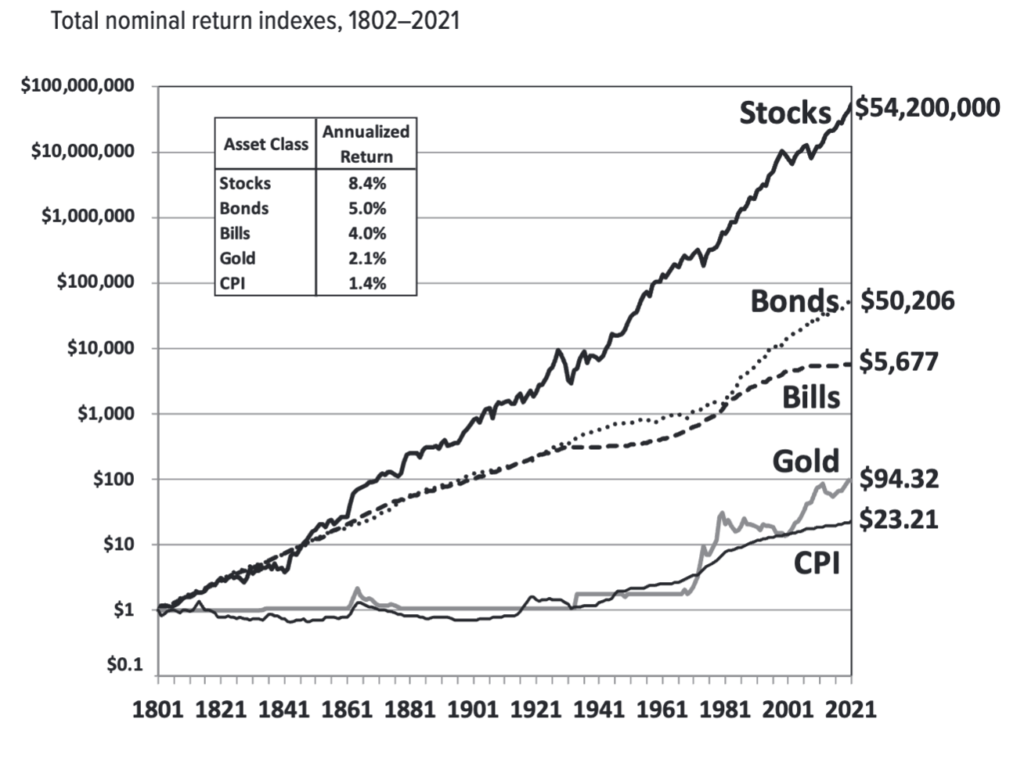

Over extended periods, stocks have proven to be one of the best investments for inflation. This long-term resilience stems from several inherent characteristics of stocks:

- Price Adjustment Capability: Well-managed companies can often raise prices to maintain profit margins and grow revenues in line with inflation.

- Real Asset Ownership: Stocks represent ownership in real assets (e.g., equipment, property, intellectual property) which typically increase in value with inflation.

- Economic Growth Correlation: Periods of moderate inflation often coincide with economic growth, benefiting many companies and their stock prices.

- Dividend Growth: Many companies increase their dividend payouts over time, providing an additional hedge against inflation for income-focused investors.

By understanding this dual nature, investors can better navigate the challenges of using stocks as an inflation hedge. The key is to maintain a long-term perspective, focusing on the enduring value creation potential of quality companies rather than getting swayed by short-term market reactions.

Stocks vs. Other Inflation Hedges

Stocks vs. Gold

Gold has long been considered a safe haven during times of economic uncertainty and inflation. However, gold doesn’t produce income or grow intrinsically like a business can. Stocks offer the potential for both capital appreciation and income through dividends.

Stocks vs. Real Estate

Like stocks, real estate can appreciate in value and generate income. However, real estate is less liquid than stocks and often requires significant capital and ongoing management. Stocks provide easier diversification and don’t come with the responsibilities of property ownership.

Stocks vs. Bonds

While certain bonds, like Treasury Inflation-Protected Securities (TIPS), are designed to keep pace with inflation, they typically offer lower long-term returns compared to stocks. Stocks provide the opportunity for greater capital appreciation and income growth over time.

Trading vs. Investing in an Inflationary Environment

When considering stocks as an inflation hedge, it’s crucial to understand the differences between trading and investing:

Short-term trading strategies may struggle during inflationary periods due to increased market volatility and uncertainty. Traders attempting to time the market or capitalize on short-term price movements face significant challenges.

Long-term investing in quality companies aligns well with using stocks as an inflation hedge. By focusing on businesses with strong fundamentals, pricing power, and the ability to grow earnings over time, investors can better position themselves to benefit from the inflation-hedging properties of stocks.

Investors who take a long-term approach can ride out short-term volatility and potentially benefit from compound growth over time. This strategy often proves more effective in preserving and growing wealth during inflationary periods.

How Different Types of Inflation Affect Stocks

Not all inflation is created equal, and different types can impact stocks in various ways:

Cost-Push vs. Demand-Pull Inflation

Cost-push inflation occurs when the costs of production increase, leading to higher prices. This type can be particularly challenging for stocks in the short term as it directly impacts company profit margins. Industries closely tied to commodities or with limited pricing power may struggle more during these periods.

Demand-pull inflation results from increased consumer demand outpacing supply. This type can actually benefit certain stocks in the short term, particularly those in consumer discretionary sectors. Companies with strong brands and pricing power may thrive in this environment.

Core Inflation vs. Food and Energy Inflation

Core inflation, which excludes volatile food and energy prices, tends to have a more sustained impact on stocks. Persistent core inflation often leads to policy responses like interest rate hikes, affecting the broader market.

Food and energy inflation, while impactful on consumers, may have a more sector-specific effect on stocks. Energy companies, for example, might benefit from rising oil prices, while consumer staples companies could face margin pressures.

Active Investing for Inflationary Environments

Active investment management can offer advantages during inflationary periods:

- Sector Rotation: Active managers can shift portfolio allocations to sectors better positioned to withstand or benefit from inflation.

- Quality Focus: Identifying companies with strong balance sheets, pricing power, and ability to pass on costs becomes crucial during inflationary times.

- Dividend Growth: Active strategies can emphasize companies with consistent dividend growth, providing an additional inflation hedge.

- Flexibility: Active managers can adjust portfolios more quickly in response to changing inflationary pressures and market conditions.

Potential Risks of Stocks during Inflation

While stocks offer strong inflation-hedging properties, it’s important to consider potential drawbacks:

- Short-Term Volatility: Stock prices can be highly volatile in the short term, which may be challenging for investors with shorter time horizons or lower risk tolerance.

- Company-Specific Risks: Not all companies successfully navigate inflationary environments. Poor management decisions or industry-specific challenges can lead to underperformance.

- Market Timing Risk: Attempting to time entries and exits based on inflationary expectations can lead to missed opportunities or realized losses.

- Diversification Concerns: Over-relying on stocks alone may expose investors to unnecessary risk. A well-rounded portfolio typically includes a mix of asset classes.

Conclusion: Embracing Stocks as a Long-Term Inflation Hedge

Stocks have proven to be one of the best investments for inflation, offering the potential for both capital appreciation and income growth. While short-term volatility is inevitable, patient investors who focus on quality companies with strong fundamentals can benefit from the inflation-fighting properties of equities.

As you consider your investment strategy in the face of inflationary pressures, remember that a well-diversified portfolio tailored to your specific goals and risk tolerance is crucial. Our team of experienced advisors is here to help you navigate these complex decisions.

Take the next step in securing your financial future. Contact us today for a complimentary financial plan review. Our advisors are ready to help you build a robust, inflation-resistant investment strategy tailored to your unique needs and goals.