It’s common to hate short sellers…

Short selling is a common technique where a speculator borrows shares of a company and sells them, hoping to buy them back later at a lower price. For this reason, practitioners are often shrouded in controversy and conspiracy theories. Many view short sellers as villains who profit off of other people’s misfortunes. However, this couldn’t be further from the truth. Short sellers can actually help diligent investors in a number of ways.

But if they’re right, the information helps avoid a loss

Short sellers can be a valuable resource for investors to avoid a loss. If a short seller has done their homework and publicly identifies a malfunctioning company, this is valuable information for long-term investors as well.

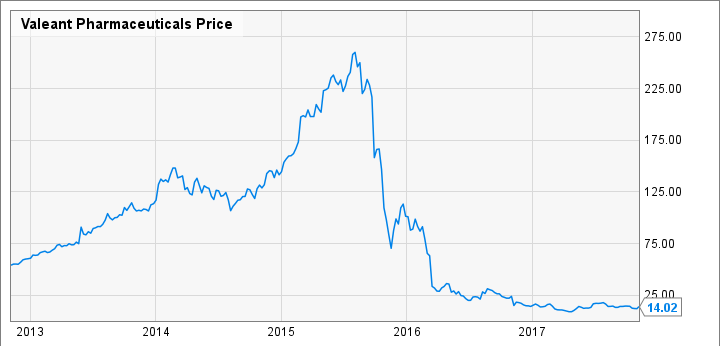

A good example of this is Valeant Pharmaceuticals. Stock commentator Andrew Left, publicly announced his short position in Valeant in 2015, citing concerns about the company’s business model, accounting practices, and debt load.

Ultimately, Valeant’s stock price fell by more than 90% from its peak. Critically, it took over a year for the stock to bottom out. Investors had ample time to verify Left’s hypothesis and cut their losses.

If they’re wrong, they lower the price for true investors

Short sellers can help lower the price of a stock by creating selling pressure in the market, which can benefit anyone who wants to invest in that stock.

In 2012, billionaire hedge fund manager Bill Ackman publicly announced a massive short position on the nutrition company Herbalife (HLF). He claimed that the company was running a pyramid scheme and that its stock was worth $0. Ackman’s announcement caused the stock to plummet as other investors followed his lead and also shorted the stock.

However, fellow billionaire investor Carl Icahn publicly disagreed with Ackman’s analysis and took a long position in Herbalife, believing the company was undervalued. Icahn even called Ackman’s comments “preposterous” and took a 25% stake in the company. This caused the stock to surge as investors bet that Icahn’s involvement could drive a turnaround in the company’s fortunes.

Either way, they provide short-term trading liquidity

Short sellers can indirectly help increase the liquidity of the market. By taking the other side of trade, short sellers increase the trading volume of a stock, which increases the liquidity in the market. Higher liquidity benefits all investors, because it makes it easier for them to buy and sell shares when they need to rebalance their portfolios.

Rarely, a short squeeze can provide the perfect exit

When short sellers are forced to buy back shares to cover their positions, it can drive up the stock’s price, creating what is known as a short squeeze. When this happens, the stock tends to trade at a higher level than its fundamentals warrant. Shareholders can sell higher than normal at the short sellers’ expense. Squeezes make great opportunities to close old investments and rotate into new one.

GME is a great example. Even today, investors can sell higher than at any time before the squeeze.

Short sellers aren’t an enemy—take advantage of them

To conclude, while short sellers are often viewed with suspicion and disdain, they can actually provide valuable insights. By identifying and publicizing weaknesses in companies, short sellers help investors avoid losses and make more informed decisions. Short selling can also increase liquidity and provide exit opportunities for investors. Rather than seeing short sellers as enemies, investors should view them as one more tool to them achieve their financial goals.