COMPANY OVERVIEW

Home to 150 Years of Horse Racing History

Churchill Downs Incorporated is a racing, online wagering and gaming entertainment company. It owns and operates iconic assets such as the Kentucky Derby and Churchill Downs Racetrack, as well as casinos and historical horse racing facilities across multiple states. The company has expanded its presence in live and historical racing, online horse race wagering, and casino gaming through strategic acquisitions and organic investments. Its operations are organized into three segments: Live and Historical Racing, TwinSpires, and Gaming. Churchill Downs continues to focus on creating unique entertainment experiences for its customers while driving profitable growth and building long-term shareholder value.

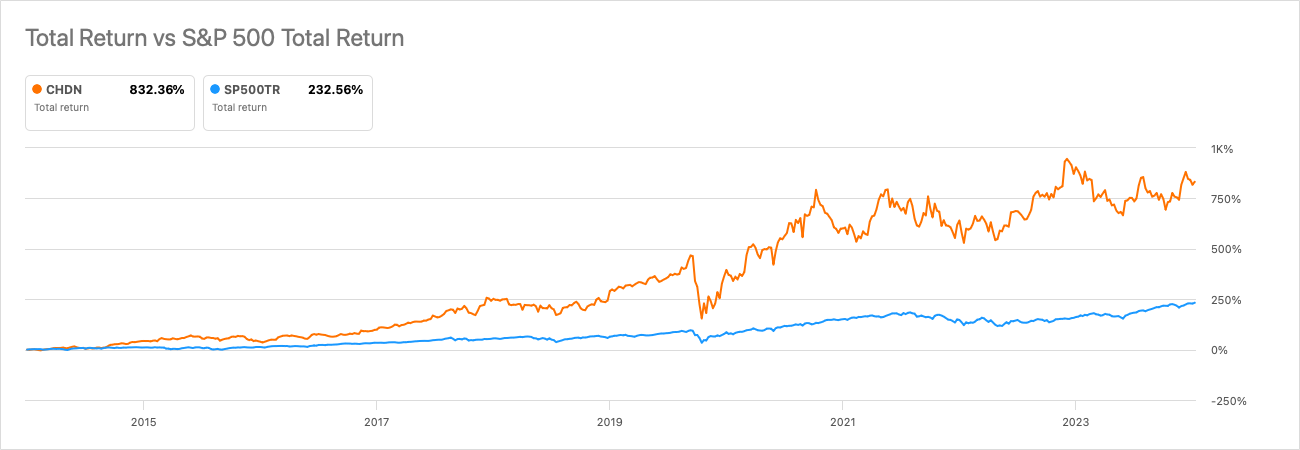

HISTORICAL PERFORMANCE

Outperformance Continues but is Declining

FINANCIAL HIGHLIGHTS

Earnings Growth Accelerates to Impressive 26%

- Record net revenue of nearly $2.5 billion in 2023, a 36% increase compared to 2022, driven by strong performance across all segments.

- Net income of $417.3 million in 2023, despite a slight decrease of 5% compared to 2022, primarily due to higher interest expenses associated with increased debt for strategic acquisitions.

- Adjusted EBITDA reached a record $1.0 billion in 2023, a 34% increase from the previous year, showcasing the company’s ability to generate strong cash flows.

- The company invested over $599 million in capital projects during 2023, focusing on expanding and enhancing its flagship Churchill Downs Racetrack, as well as developing new Historical Horse Racing (HRM) entertainment venues.

QUANTITATIVE RANKINGS

Ranked in The 1st Quartile in 2 Factors

GROWTH STORY

Bringing Horse Racing into the 21st Century

Churchill Downs’ growth over the next 3-5 years will be driven by expanding its historical horse racing (HRM) operations, investing in the Kentucky Derby, and growing its gaming properties. HRM technology, which the company acquired through its purchase of Exacta Systems, allows customers to bet on previously run horse races on slot machine-like devices. This technology is a key growth driver for the company, as it enables Churchill Downs to offer a unique gaming experience and attract new customers. Additionally, the company’s partnerships with sports betting leaders DraftKings and FanDuel will provide new opportunities for revenue growth by tapping into the increasingly popular online sports wagering market. These initiatives, combined with Churchill Downs’ strong brand, solid financial position, and experienced leadership team, position the company to deliver robust growth and create value for shareholders in the coming years.

RISK FACTORS

Gambling Industry Remains Exposed to Consumer Confidence

- Exposure to consumer confidence, as economic downturns may reduce discretionary spending on gaming and entertainment.

- High reliance on the Kentucky Derby, as any disruption to the event could significantly impact revenue and profitability.

- Regulatory risks associated with the gaming industry, which could affect the company’s ability to operate or expand.

- Execution risk related to capital projects, potentially leading to delays, cost overruns, or lower-than-expected returns.

MAGNIFINA'S OUTLOOK

Things look promising for Churchill Downs.

- Strongly Positive

- Positive

- Neutral

- Negative

- Strongly Negative

The flagship Kentucky Derby event is gaining among younger generations due to its spectacle. Expanding access to racing via online platforms and HRMs provides a novel alternative to traditional Las Vegas table games and slot machines. An economic slowdown presents a short-term risk, but looking to the long-term, this company has excellent growth prospects at a reasonable valuation.

Disclosure: Some of Magnifina’s clients (including the author) hold a position in this stock at the time of publication.