COMPANY OVERVIEW

Health Plans and Pharmacy Benefit Management

The Cigna Group is a global health services company that offers a wide range of pharmacy, medical, behavioral, dental, and related products and services. The company operates through two main segments: Evernorth Health Services, which provides pharmacy benefits, specialty pharmacy services, and health care management solutions, and Cigna Healthcare, which offers comprehensive medical and coordinated solutions, including U.S. commercial, government, and international health plans. Cigna serves over 190 million customer relationships across more than 30 countries and jurisdictions.

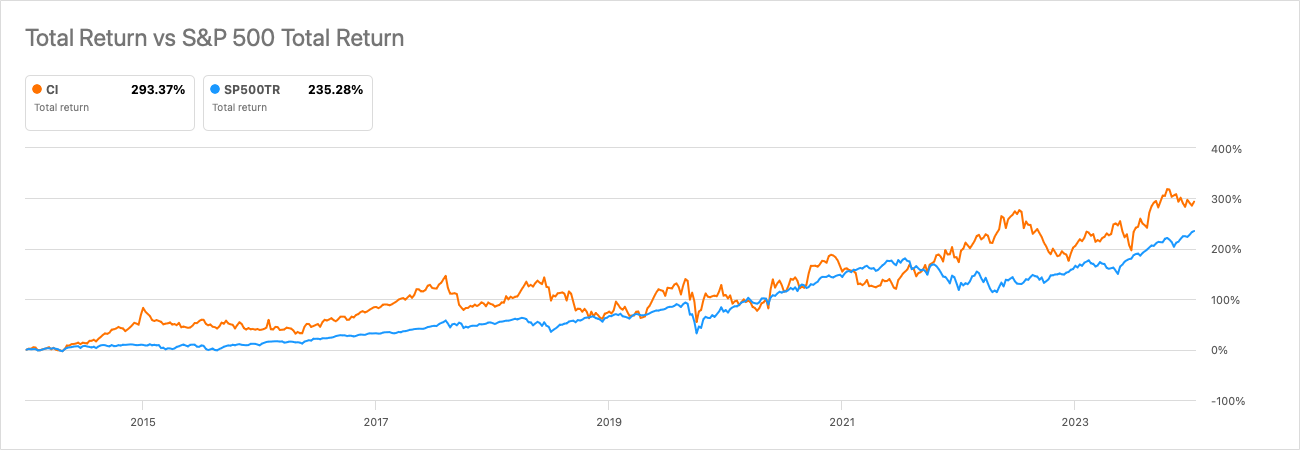

HISTORICAL PERFORMANCE

Steady Alpha over Past 10 Years

FINANCIAL HIGHLIGHTS

Strong Revenue Growth albeit Slower Operating Income

- Total revenues increased by 8% to $195.3 billion in 2023 compared to 2022.

- The Cigna Healthcare segment experienced a 14% increase in adjusted revenues, reaching $51.2 billion in 2023.

- The Evernorth Health Services segment reported adjusted revenues of $153.5 billion in 2023, a 9% increase from 2022.

- Medical customers increased by 10% to 19.8 million in 2023.

- However, adjusted income from operations grew by only 2% to $7.4 billion in 2023. (Attributed to pending Medicare spin-off)

QUANTITATIVE RANKINGS

Ranked in The 1st Quartile in all 3 Factors!

GROWTH STORY

Focusing on Expanding Core Business Segments

The Cigna Group has several ways it plans to grow in the future. One important area is using technology and data to create personalized health experiences that are more affordable and convenient for customers. The company is investing in digital health tools, like telemedicine and remote monitoring, to make it easier for people to get care when and where they need it. Cigna is also focusing on expanding its services to help people with mental health needs, which are becoming more common and important. The company wants to make it simpler for customers to access behavioral health support as part of their overall care. Cigna has already sold its property/casualty insurance unit, and is working to sell its Medicare Advantage unit allowing for more focus on core healthcare and pharmacy businesses.

RISK FACTORS

Walking a Regulatory Tightrope

- Regulatory and legislative changes in the heavily regulated healthcare industry can significantly impact operations, profitability, and offerings.

- The pending sale of The Cigna Group’s Medicare Advantage and related businesses to HCSC is subject to regulatory approvals and other closing conditions

- The increasing prevalence of chronic diseases and an aging population could lead to higher healthcare costs and utilization, straining the healthcare system.

- Public health crises, such as pandemics, can create significant operational and financial challenges, as well as shifts in healthcare demand and delivery.

- Cigna’s pharmacy benefit management business, may face increased political and regulatory pressure due to concerns about the role of PBMs in the supply chain and drug prices.

MAGNIFINA'S OUTLOOK

Cigna is Poised for Stable Long-term Growth

- Strongly Positive

- Positive

- Neutral

- Negative

- Strongly Negative

The Cigna Group is a well-positioned leader in the health services industry, offering innovative services to core healthcare markets. With its strong market presence, focused business segments, and strategic investments in technology and care delivery, the company is poised for sustainable, long-term growth. Despite potential challenges, Cigna’s demonstrated adaptability and compelling valuation make it an attractive investment opportunity.

Disclosure: Some of Magnifina’s clients (including the author) hold a position in this stock at the time of publication.