Recession avoided but uncertainty remains

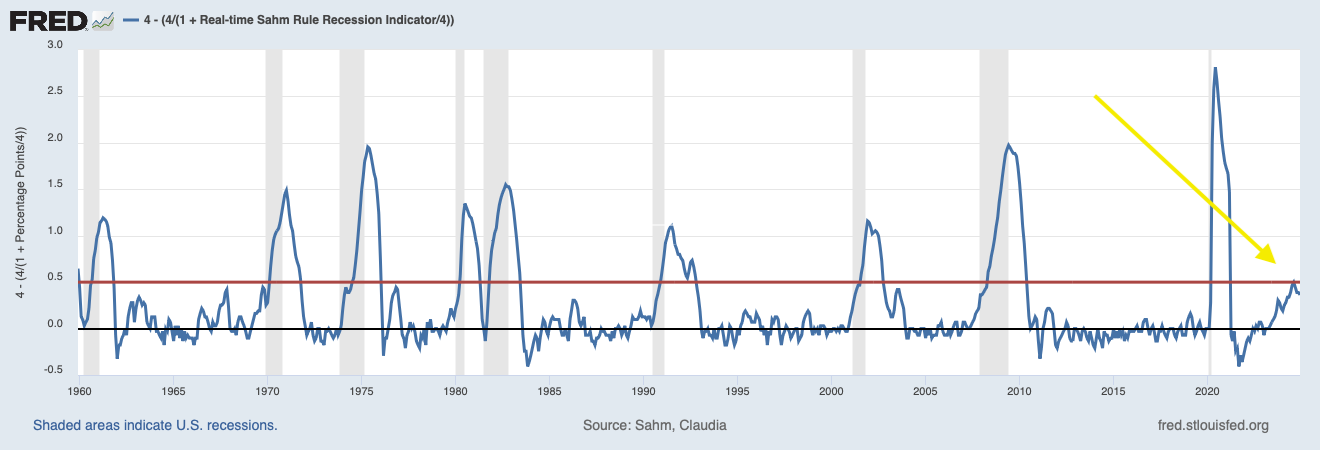

Many recession indicators have moderated over the past quarter. In November, The Conference Board’s Leading Economic Index increased for the first time after 2 years of decline. The Sahm Rule recession indicator has also declined after briefly crossing the critical value of 0.5%. Both of these indicators have a truly excellent track record of predicting recessions. At this point in time, these indicators have very rarely made such a strong signal only to reverse course. Indeed, these signals suggest the economy has likely moved past its highest risk of recession, at least for now.

Nevertheless, the stock market valuation remains historically elevated. By several measures, including the so-called Buffett Indicator, the S&P 500 is as highly valued as it was at the end of 2021, which represented a high-watermark until 2024. Goldman Sachs, Vanguard, and other institutions are forecasting below-average stock market returns over the next decade. This is not to say that a crash is imminent, but it does mean that continued returns of 10% are unlikely. We could see a flat or choppy sideways market going forward, depending on volatility. In this environment, investors can look toward individual stocks to maintain steady growth. If the market indices are being held back by overweighted components, then smaller and more nimble companies may continue to trend higher.

Political uncertainty also presents risks and the potential for volatility. While markets historically ignore partisan politics, this time the issues surround potential major structural changes to the economy. Though major policy shifts face significant barriers, markets may not dismiss these risks as easily as in past cycles. Headlines out of Washington may create more volatility than previously.

Market Commentary: 2025 Q1

Recession avoided but uncertainty remains

Many recession indicators have moderated over the past quarter. In November, The Conference Board’s Leading Economic Index increased for the first time after 2 years of decline. The Sahm Rule recession indicator has also declined after briefly crossing the critical value of 0.5%. Both of these indicators have a truly excellent track record of predicting recessions. At this point in time, these indicators have very rarely made such a strong signal only to reverse course. Indeed, these signals suggest the economy has likely moved past its highest risk of recession, at least for now.

Nevertheless, the stock market valuation remains historically elevated. By several measures, including the so-called Buffett Indicator, the S&P 500 is as highly valued as it was at the end of 2021, which represented a high-watermark until 2024. Goldman Sachs, Vanguard, and other institutions are forecasting below-average stock market returns over the next decade. This is not to say that a crash is imminent, but it does mean that continued returns of 10% are unlikely. We could see a flat or choppy sideways market going forward, depending on volatility. In this environment, investors can look toward individual stocks to maintain steady growth. If the market indices are being held back by overweighted components, then smaller and more nimble companies may continue to trend higher.

Political uncertainty also presents risks and the potential for volatility. While markets historically ignore partisan politics, this time the issues surround potential major structural changes to the economy. Though major policy shifts face significant barriers, markets may not dismiss these risks as easily as in past cycles. Headlines out of Washington may create more volatility than previously.

Get insights delivered to your inbox and never miss our latest research and key developments. Our monthly roundup includes analysis, updates, and other resources for serious investors.

Related Posts

Market Commentary: 2026 Q1

Seven Warren Buffett gold quotes every investor should understand

16 of the Worst Investments in History: How to Avoid the Next One

Share This Story

Are we right for you?

Take our brief survey to learn if our advisory services are the best match for your financial goals and situation, and see if we should move forward together.

Ready for the first step?

Schedule a no-cost consultation to discuss your financial goals and explore how we can help you build a personalized investment strategy.