Valuations remain at record highs

The stock market reached new heights over the past three months, with major indices hitting all-time records despite ongoing economic uncertainties. The summer rally showed impressive breadth, with both large technology companies and smaller firms participating. Corporate earnings continued to exceed expectations, providing fundamental support for the advance even as questions emerged about the sustainability of current valuations. This resilience has been notable, particularly given the volatility experienced earlier in the year.

Federal Reserve policy remained center stage as Chair Powell signaled a potential shift toward lower interest rates at the Jackson Hole symposium. After maintaining rates, Powell’s comments opened the door to resuming rate cuts, giving markets an additional boost. The central bank finds itself walking a tightrope between supporting the labor market and managing inflation. The weak August employment report has bolstered the case for rate cuts, with markets current expecting action at the September meeting.

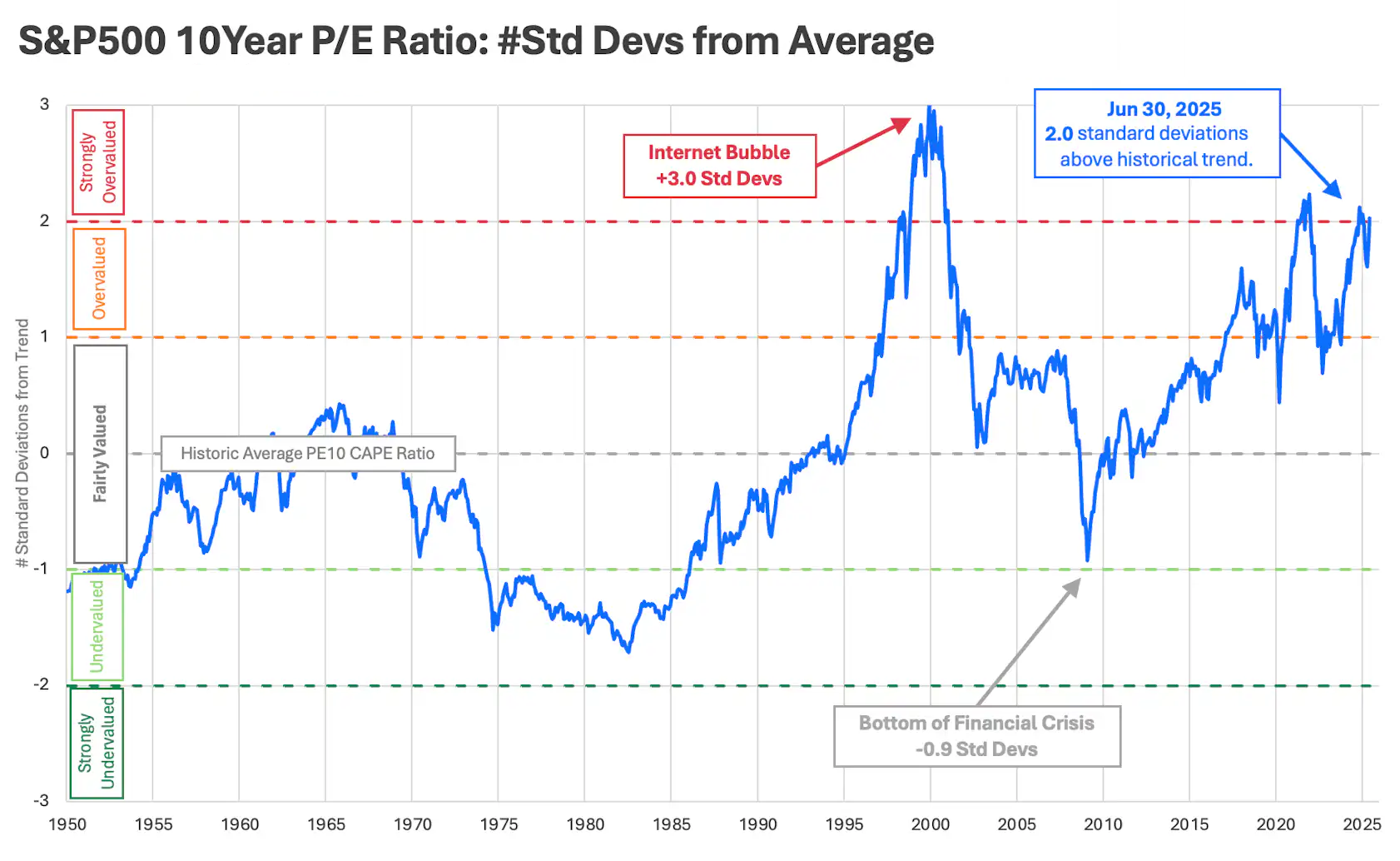

Looking forward, it’s important to consider that stock valuations sit well above their historical averages. This situation may reflect expectations of persistent inflation rather than optimism about business growth. With the market’s price-to-earnings ratio near 27-30, compared to a long-term average closer to 16-20, stocks are priced at levels that historically have preceded lower returns. The federal deficit is projected to reach $1.9 trillion this year, with debt ratios rising to levels not seen since WWII. This combination of tariff-driven price pressure and massive deficit spending creates an inflationary environment. Owning real assets can potentially keep pace with inflation, even if those assets appear expensive by traditional measures.

Market Commentary: 2025 Q3

Valuations remain at record highs

The stock market reached new heights over the past three months, with major indices hitting all-time records despite ongoing economic uncertainties. The summer rally showed impressive breadth, with both large technology companies and smaller firms participating. Corporate earnings continued to exceed expectations, providing fundamental support for the advance even as questions emerged about the sustainability of current valuations. This resilience has been notable, particularly given the volatility experienced earlier in the year.

Federal Reserve policy remained center stage as Chair Powell signaled a potential shift toward lower interest rates at the Jackson Hole symposium. After maintaining rates, Powell’s comments opened the door to resuming rate cuts, giving markets an additional boost. The central bank finds itself walking a tightrope between supporting the labor market and managing inflation. The weak August employment report has bolstered the case for rate cuts, with markets current expecting action at the September meeting.

Looking forward, it’s important to consider that stock valuations sit well above their historical averages. This situation may reflect expectations of persistent inflation rather than optimism about business growth. With the market’s price-to-earnings ratio near 27-30, compared to a long-term average closer to 16-20, stocks are priced at levels that historically have preceded lower returns. The federal deficit is projected to reach $1.9 trillion this year, with debt ratios rising to levels not seen since WWII. This combination of tariff-driven price pressure and massive deficit spending creates an inflationary environment. Owning real assets can potentially keep pace with inflation, even if those assets appear expensive by traditional measures.

Get insights delivered to your inbox and never miss our latest research and key developments. Our monthly roundup includes analysis, updates, and other resources for serious investors.

Related Posts

Market Commentary: 2026 Q1

Seven Warren Buffett gold quotes every investor should understand

16 of the Worst Investments in History: How to Avoid the Next One

Share This Story

Are we right for you?

Take our brief survey to learn if our advisory services are the best match for your financial goals and situation, and see if we should move forward together.

Ready for the first step?

Schedule a no-cost consultation to discuss your financial goals and explore how we can help you build a personalized investment strategy.