AI Capex and Portfolio Considerations

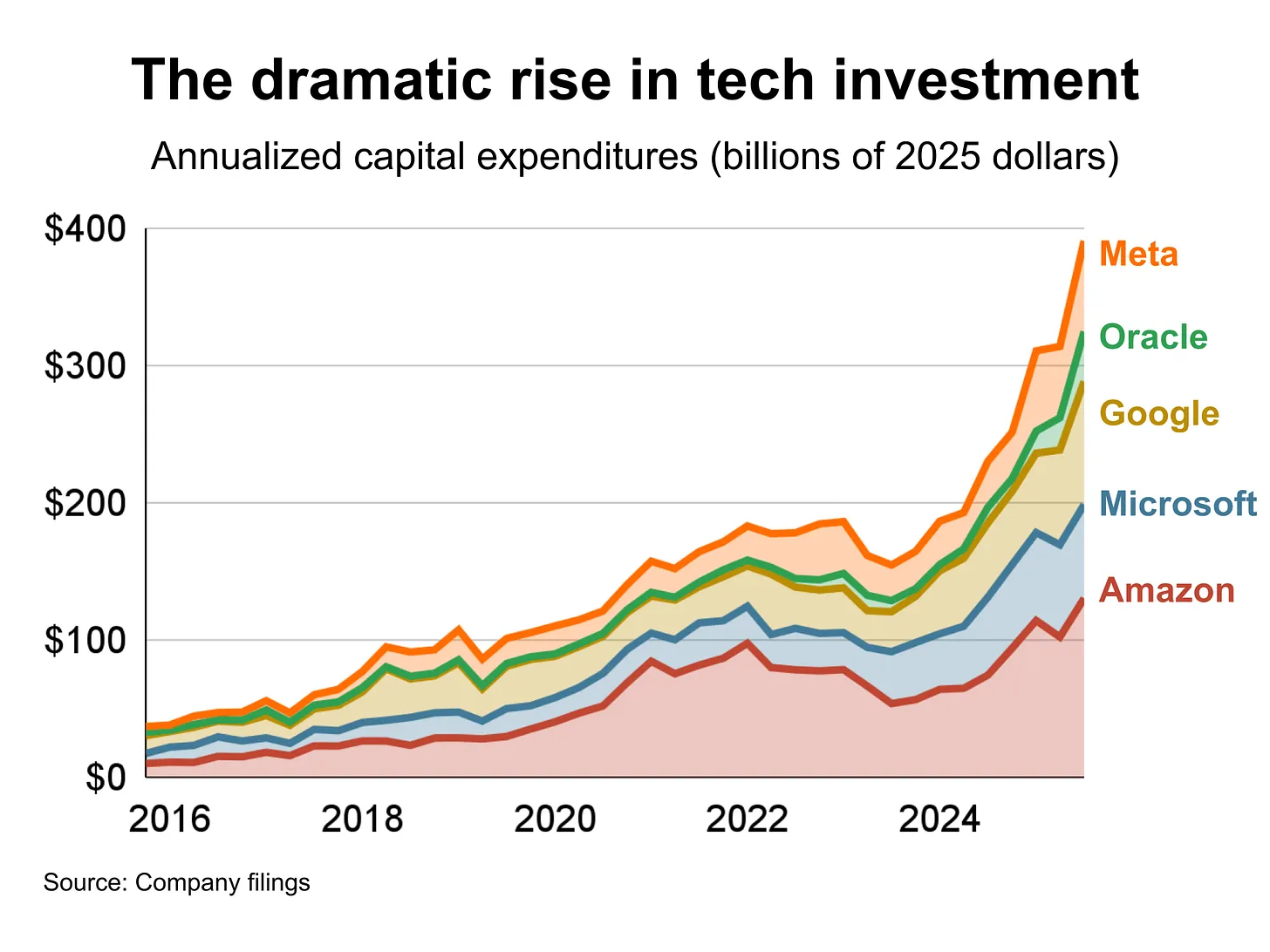

AI-related capital expenditures contributed more to U.S. GDP growth in the first half of 2025 than consumer spending, a historic first. Microsoft, Amazon, Alphabet, and Meta are on track to spend over $340 billion on AI infrastructure this year alone. Some economists argue that without this investment surge, the economy would be in recession. That’s a remarkable concentration of growth in a single theme, and it carries risks that prudent investors should understand.

The recent debate sparked by investor Michael Burry highlights one such risk: the accounting treatment of AI hardware. Hyperscalers have extended the depreciation schedules on their AI chips to five or six years, while Nvidia releases new chip generations annually. Critics argue this mismatch flatters near-term earnings and obscures the true cost. Nvidia counters that its software ecosystem extends chip usefulness, and there is ongoing demand for older hardware for certain workloads. The reality likely falls somewhere in between, but the gap between assumptions could mean billions in earnings adjustments over the coming years.

This environment reinforces our approach of favoring quality companies with durable business models over momentum-driven positions. While some of our holdings have benefited from AI-related tailwinds, we’ve been deliberate about avoiding overconcentration in a single narrative. History offers instructive parallels: the late-1990s telecom buildout left behind valuable fiber infrastructure, but investors suffered losses. AI may prove transformational over time. The stocks trading at today’s valuations may not reward investors proportionally. We continue to position portfolios for a range of outcomes rather than betting on any single scenario.

Market Commentary: 2025 Q4

AI Capex and Portfolio Considerations

AI-related capital expenditures contributed more to U.S. GDP growth in the first half of 2025 than consumer spending, a historic first. Microsoft, Amazon, Alphabet, and Meta are on track to spend over $340 billion on AI infrastructure this year alone. Some economists argue that without this investment surge, the economy would be in recession. That’s a remarkable concentration of growth in a single theme, and it carries risks that prudent investors should understand.

The recent debate sparked by investor Michael Burry highlights one such risk: the accounting treatment of AI hardware. Hyperscalers have extended the depreciation schedules on their AI chips to five or six years, while Nvidia releases new chip generations annually. Critics argue this mismatch flatters near-term earnings and obscures the true cost. Nvidia counters that its software ecosystem extends chip usefulness, and there is ongoing demand for older hardware for certain workloads. The reality likely falls somewhere in between, but the gap between assumptions could mean billions in earnings adjustments over the coming years.

This environment reinforces our approach of favoring quality companies with durable business models over momentum-driven positions. While some of our holdings have benefited from AI-related tailwinds, we’ve been deliberate about avoiding overconcentration in a single narrative. History offers instructive parallels: the late-1990s telecom buildout left behind valuable fiber infrastructure, but investors suffered losses. AI may prove transformational over time. The stocks trading at today’s valuations may not reward investors proportionally. We continue to position portfolios for a range of outcomes rather than betting on any single scenario.

Get insights delivered to your inbox and never miss our latest research and key developments. Our monthly roundup includes analysis, updates, and other resources for serious investors.

Related Posts

Market Commentary: 2026 Q1

Seven Warren Buffett gold quotes every investor should understand

16 of the Worst Investments in History: How to Avoid the Next One

Share This Story

Are we right for you?

Take our brief survey to learn if our advisory services are the best match for your financial goals and situation, and see if we should move forward together.

Ready for the first step?

Schedule a no-cost consultation to discuss your financial goals and explore how we can help you build a personalized investment strategy.