COMPANY OVERVIEW

A Leader in High-Efficiency HVAC Solutions

AAON Inc., established in 1988 by Norman H. Asbjornson and

headquartered in Tulsa, Oklahoma, is a leading manufacturer of high-efficiency HVAC (Heating,

Ventilation, and Air Conditioning) systems. Initially focused on providing reliable climate control

solutions, AAON has evolved into a major industry player known for its commitment to

innovation and energy efficiency. With a comprehensive product line that includes rooftop units,

air handlers, chillers, heat pumps, and condensing units, AAON serves a diverse range of

commercial and industrial clients. The company’s reputation for quality and its ability to offer

customized solutions make it a preferred choice in the HVAC market. Under the leadership of

Gary D. Fields, AAON has expanded its production capacity and workforce, further solidifying its

position as a leader in sustainable HVAC technology.

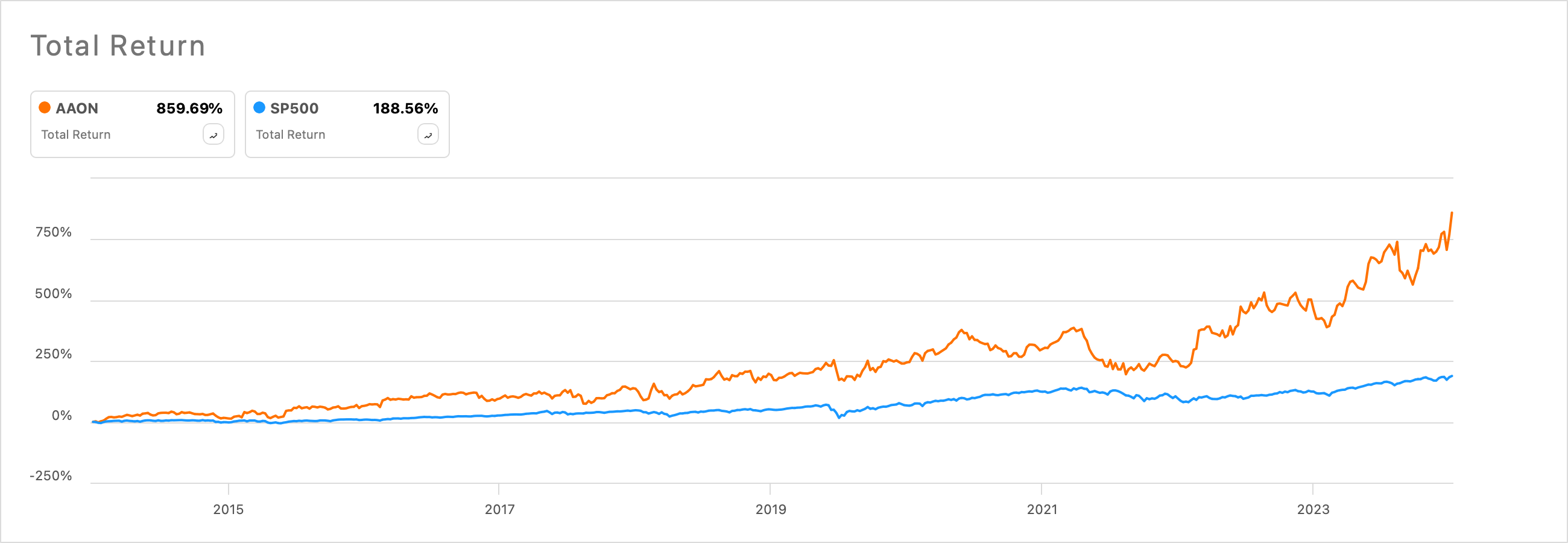

HISTORICAL PERFORMANCE

Outstanding Historical Outperformance

FINANCIAL HIGHLIGHTS

AAON Demonstrates Strong Performance and Growth Potential

- AAON achieved a ROC of 23.0% in 2024, surpassing competitors such as Johnson Controls

International plc (9.7%) and Trane Technologies plc (15.0%). This indicates AAON’s superior ability to generate profit from invested capital. - AAON’s gross margins increased from 29% to 35.2% from Q1 2023 to Q1 2024. This

improvement reflects effective cost management and pricing strategies, even amid revenue and EPS misses in Q1 2024. - AAON holds an S&P credit rating of A, which indicates solid financial health. Compared to

competitors, this rating reflects strong financial stability. For instance, Trane Technologies plc

has a similar credit rating, while Johnson Controls International plc has a slightly lower rating of

BBB+. This suggests AAON’s stronger financial positioning. - AAON’s focus on replacement revenue rather than new construction has provided a stable

revenue base, mitigating exposure to economic cycles. This strategic shift helps counterbalance

the volatility typical of new construction markets.

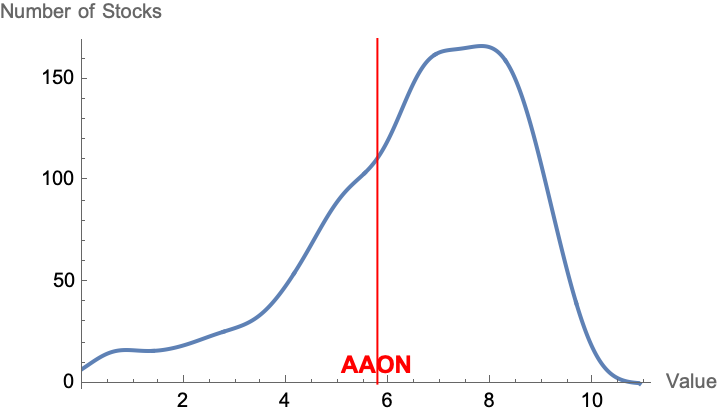

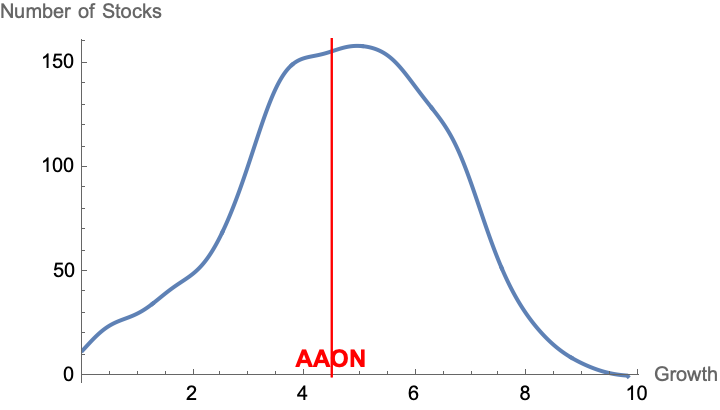

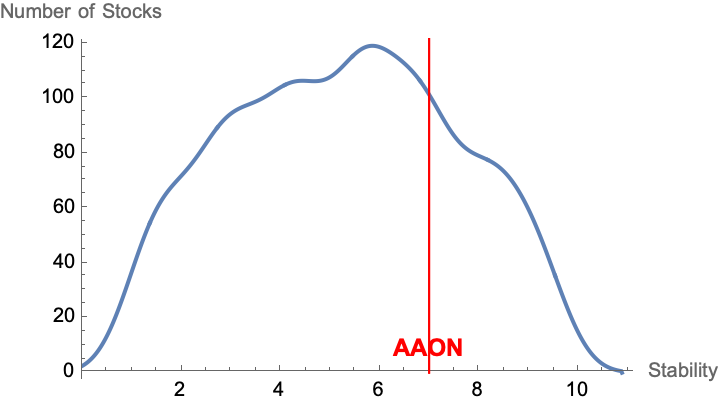

QUANTITATIVE RANKINGS

Average Rankings Don’t Fully Encapsulate the Opportunity

GROWTH STORY

A Strategic Approach to Expanding Market Share and Enhancing Product Portfolio

AAON’s growth strategy focuses on expanding market share and refining its product portfolio.

The shift towards prioritizing replacement revenues over new construction has allowed AAON to

stabilize revenue streams by reducing exposure to construction market fluctuations.

While AAON maintains zero long-term debt, its investment strategy is centered around

high-margin, growth areas like the data center market. The lack of debt facilitates strategic

reinvestment in these high-margin segments, though leveraging debt for such investments could

also be a viable option for optimizing returns.

The company’s R&D investments have yielded advanced HVAC systems that excel in energy

efficiency, addressing stringent regulations and enhancing cost-effectiveness. This innovation

supports AAON’s ability to capture a significant share of the $6 billion HVAC rooftop market.

The recent acquisition of BASX Solutions extends AAON’s product capabilities into

high-demand sectors like biopharmaceuticals and semiconductors, which require more precise

and reliable climate control than standard applications. This acquisition likely contributes to

higher margins due to the advanced technology and customization required for these markets.

AAON’s operational model uniquely combines high-volume manufacturing with the flexibility for

customized solutions. This dual approach allows AAON to achieve economies of scale while

meeting specific customer requirements, maintaining a competitive edge in both broad and

niche markets.

RISK FACTORS

Key Could Affect AAON’s Performance

- Economic Sensitivity: Dependence on the construction and replacement markets

exposes AAON to economic cycles and downturns. - Raw Material Costs: Fluctuations in the prices of key raw materials, such as steel,

aluminum, and copper, can impact AAON’s profitability. - Regulatory Compliance: Changes in environmental and energy efficiency regulations

and laws may require costly adjustments to products and operations. - Supply Chain Disruptions: Vulnerability to disruptions in the supply chain can affect

production schedules and product delivery. - Technological Advancements: The need to continuously innovate and keep pace with

technological advancements in the HVAC industry.

MAGNIFINA'S OUTLOOK

AAON’s Strategic Position and Future Prospects

- Strongly Positive

- Positive

- Neutral

- Negative

- Strongly Negative

Looking ahead, AAON’s strategic shift towards high-margin sectors, such as data centers and biopharmaceuticals, along with its focus on energy-efficient solutions, positions the company uniquely in the HVAC industry. Unlike its competitors, AAON’s operational model integrates advanced manufacturing techniques with customizable solutions, enhancing its ability to meet diverse market needs and command premium prices. This differentiation, coupled with a high return on capital and a strong credit rating, indicates that AAON is well-equipped to leverage emerging opportunities and manage potential risks effectively. As a result, AAON’s approach not only supports its current profitability but also aligns with long-term industry trends favoring sustainability and innovation.

Disclosure: Some of Magnifina’s clients (including the publisher) hold a position in this stock at the time of publication.