COMPANY OVERVIEW

A Broad Portfolio of Industrial Components

Parker-Hannifin Corporation, founded in 1938 and headquartered in Ohio, is a global leader in

motion and control technologies. Serving diverse sectors including aerospace, clean technology,

and industrial products, Parker-Hannifin is the third-largest entity in the specialty industrial

machinery sector, with operations spanning 44 countries. The company’s four major platforms –

Filtration & Engineered Materials, Aerospace Systems, Flow & Process Control, and Motion

Systems – enable it to meet the needs of approximately 550,000 customers worldwide. This

diversified portfolio, combined with strategic acquisitions, has strengthened its competitive

position across various markets.

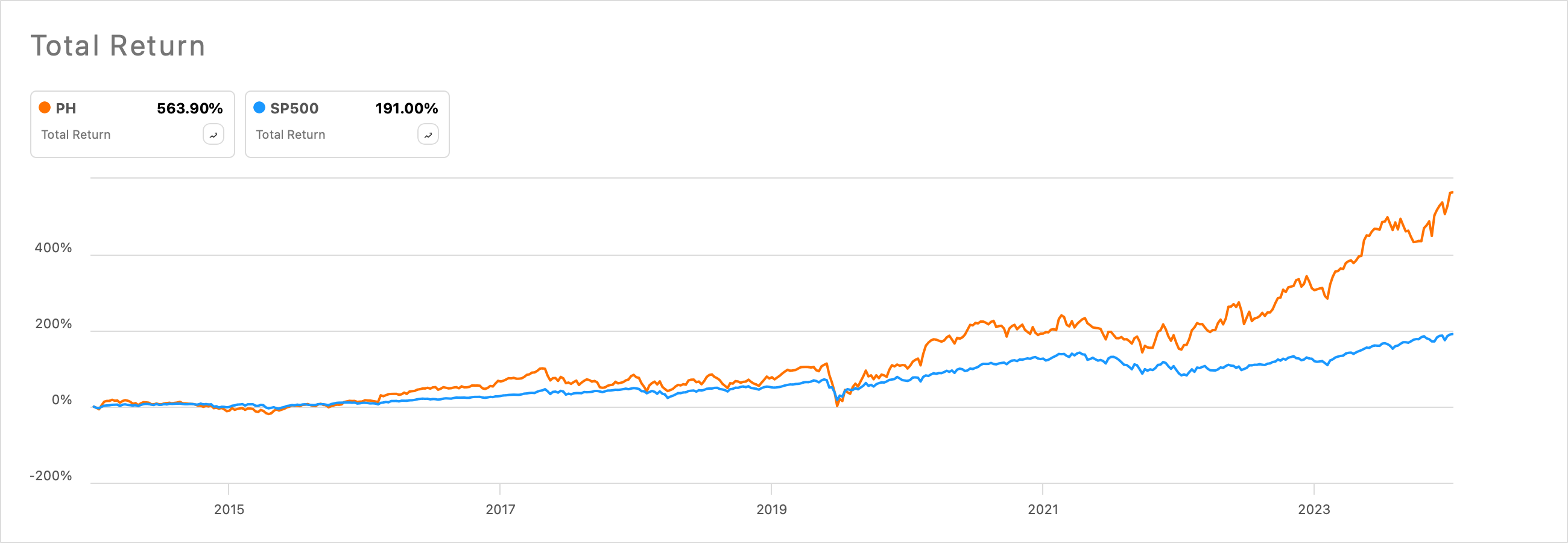

HISTORICAL PERFORMANCE

Excellent Post-Pandemic Performance

FINANCIAL HIGHLIGHTS

Margin Expansion Results in Much Higher Free Cash Flow (FCF)

- Parker-Hannifin currently shows a price-to-earnings (PE) ratio of approximately 19.9

- The company has realized an increase in adjusted operating margins during the past 5 years

from ~18% to ~24% - Parker-Hannifin’s free cash flow has notably doubled, rising from $1.5 billion to $3.0 billion in

the past five years, underscoring the company’s robust cash generation capabilities and its

ability to fund future growth and return capital to shareholders. - Parker-Hannifin is dedicated to returning value to its shareholders, with plans to increase its

dividend by 68% over the next five years. The current dividend yield stands near 1.2%, and the

dividend itself has grown at a compound annual growth rate (CAGR) of 14% over the past five

years. - Parker-Hannifin holds an S&P credit rating of BBB+, indicating a moderate credit risk and suggesting that the company has some capacity to meet its financial commitments.

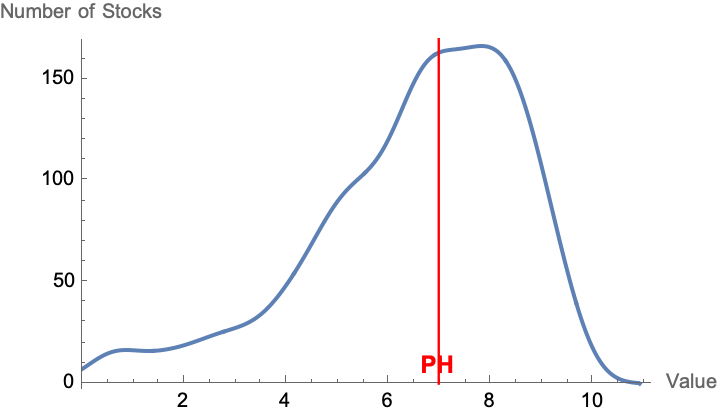

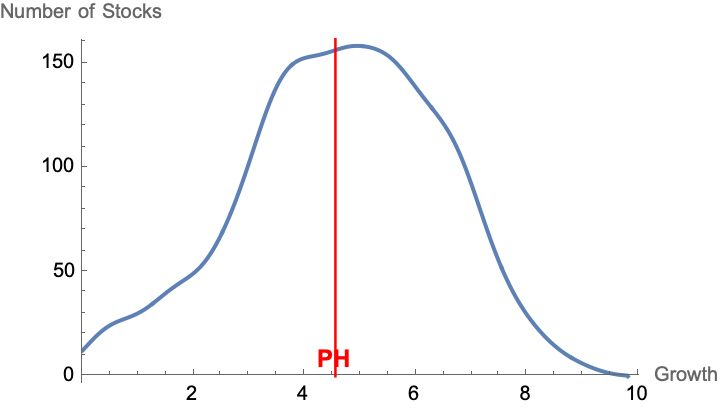

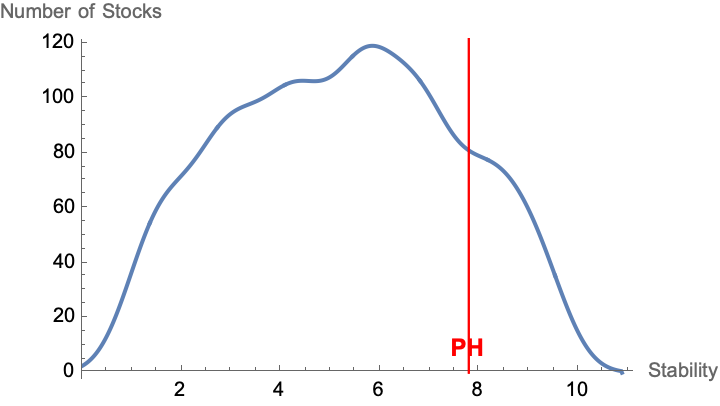

QUANTITATIVE RANKINGS

Excellent Stability for Balanced Growth and Value

GROWTH STORY

Supplying Future High-Growth Technologies

Parker-Hannifin’s growth strategy, known as ‘Win Strategy 3.0,’ emphasizes investment in

advanced manufacturing technologies, supply chain optimization, and the expansion of digital

capabilities. This approach includes integrating robotics into its product lineup, positioning the

company to meet the increasing demand for automation and advanced manufacturing solutions

in various industries.

In 2023, Parker-Hannifin further strengthened its market position by acquiring Meggitt plc. This

strategic acquisition expanded Parker-Hannifin’s product portfolio, particularly in the high-growth

aerospace and defense sectors, and aligned with its broader goals of enhancing its competitive

edge.

The company is also focusing on emerging trends like electrification within aerospace and

off-highway vehicles. While it remains cautious about speculative technologies such as

hydrogen fuel cells, Parker-Hannifin is well-positioned to capitalize on electrification, which is

seen as a more immediate and practical growth avenue.

With these initiatives, Parker-Hannifin is targeting a 10% annual EPS growth by 2029,

underpinned by ongoing improvements in operational efficiency, which have already resulted in

significant gains in adjusted operating margins.

RISK FACTORS

Exposure to Cyclical Industries Like Aerospace

- Economic Sensitivity: As an industrial company, Parker-Hannifin’s performance is closely tied

to broader economic conditions, making it vulnerable to economic downturns. - Cyclicality: Despite focusing on secular growth markets, Parker-Hannifin’s business remains

cyclical, particularly in its aerospace segment. - Execution Risks: The company’s ambitious growth targets rely on successful execution of its

strategies, including the continued expansion into clean technology and electrification. - Competition: Parker-Hannifin faces strong competition in its key markets, particularly in

aerospace and industrial products, which could pressure margins and market share.

MAGNIFINA'S OUTLOOK

Parker-Hannifin’s Strategic Position and Future Prospects

- Strongly Positive

- Positive

- Neutral

- Negative

- Strongly Negative

Magnifina maintains a cautious but positive rating on Parker-Hannifin. While the company’s current valuation suggests limited near-term upside, its strong position in aerospace, coupled with their focus on long-term secular trends like clean technology and electrification, supports a positive outlook. We believe Parker-Hannifin’s ambitious targets for revenue, margins, and free cash flow provide a solid foundation for sustainable long-term growth. However, investors should be mindful of the risks associated with its valuation and economic sensitivity.

Disclosure: Some of Magnifina’s clients hold a position in this stock at the time of publication.