Bed Bath & Beyond, a quintessential retail chain and recent meme stock, has filed for bankruptcy as of Sunday afternoon. The company’s struggles signal drastic changes in the retail sector, and the implications of this bankruptcy extend far beyond a single store. With some analysts predicting that thousands retail stores will close in the United States over the next three years, the future of brick-and-mortar retail is far from certain. Other major retailers have seen their stocks plummet over 80% from their post-pandemic highs. Let’s explore the implications of Bed Bath & Beyond’s bankruptcy and what it could mean for the future of the industry.

The changing retail landscape

Retail stores have been closing down for many years, and this trend was only exacerbated by the COVID-19 pandemic. Consumer preferences for online shopping has left traditional brick-and-mortar retailers struggling to keep up. The pandemic forced many retailers to temporarily close and that lost revenue was critical.

Bed Bath & Beyond is a prime example of a company that has struggled to adapt to these changes. Although they attempted to transition to an omnichannel strategy and integrate online sales into their business model, it was apparently too little too late. We also think their Price Volume Mix strategy targeting low-end merchandise did not appeal to a rising Millennial generation seeking higher quality items.

Is BBBY stock worth anything?

With a bankruptcy liquidation, creditors are repaid in order of priority. After paying vendors, employee wages, and other unsecured creditors, bondholders are repaid the up to the whole value of their bonds. With $1.5 billion of outstanding bonds, it’s not likely there will be much left over for holders of common stock. Their most valuable asset might be the Bed Bath & Beyond brand, but it’s unlikely to fully compensate all creditors if sold.

Who might be the next retailer to fail?

Wayfair

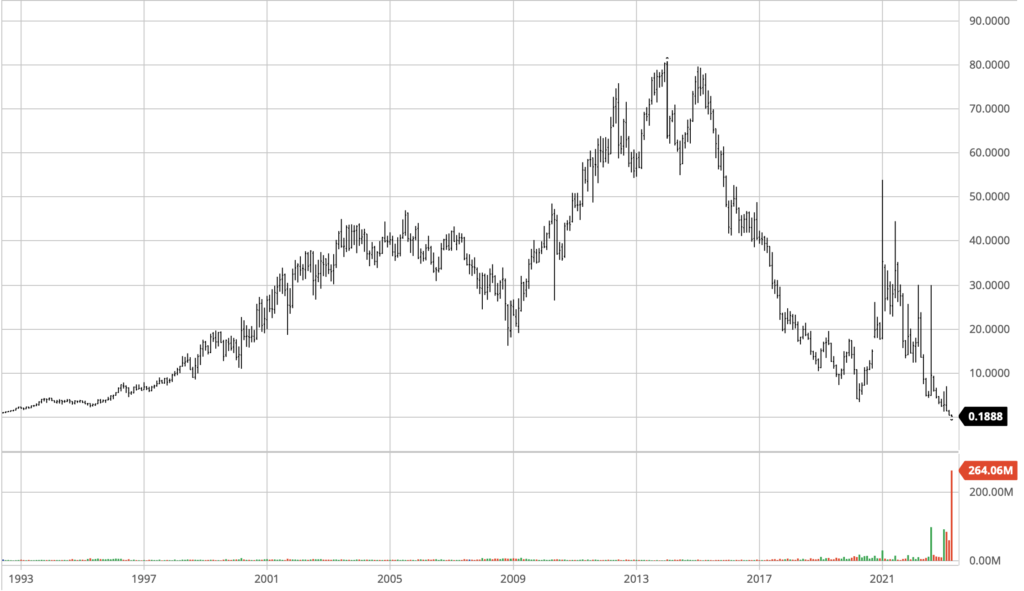

Wayfair’s stock has dropped nearly 90% from its post-pandemic high despite being an online retailer. The company faces pressure on profit margins due to aggressive advertising spending and increased competition.

The Container Store

The Container Store’s stock has plummeted over 80% from its post-pandemic high and over 92% from its all-time high. They are struggling with the decline in foot traffic and changing consumer preferences. The company’s heavy reliance on costly physical stores leaves it vulnerable to competition from e-commerce.

Kirkland’s

Kirkland’s stock price has also declined by over 90% since its post-pandemic high. As of the time of writing, its market cap is a measly $37 million. Despite efforts to improve its digital presence, Kirkland’s has clearly struggled to keep pace with the rapidly evolving retail environment.

Conclusion: A risky road ahead

The bankruptcy of Bed Bath & Beyond and the projected closure of thousands of retail stores in the coming years should serve as a wake-up call for the whole retail industry. Retailers must adapt to new consumer behaviors and embrace e-commerce to stay competitive. Investors would be prudent to approach this industry with caution and carefully analyze potential stocks for resilience.