Stock market rumors have spread on internet message boards for decades and across other media in earlier ages. Yet, the market volatility caused by the 2021 GME short squeeze is unprecedented in many ways. Goldman Sachs calls it the biggest short squeeze in 25 years as its effects spill over from GME into several other stocks and markets.

Unfortunately, this event was fueled by extreme amounts of misinformation, propaganda, superstition, and nonsense. Many of the false claims found in Reddit posts are directly addressed by the SEC in a FAQ about short selling regulations.

Even still, several myths about this trade persist, and are discussed below:

Myth: The squeeze will occur after Jan 29

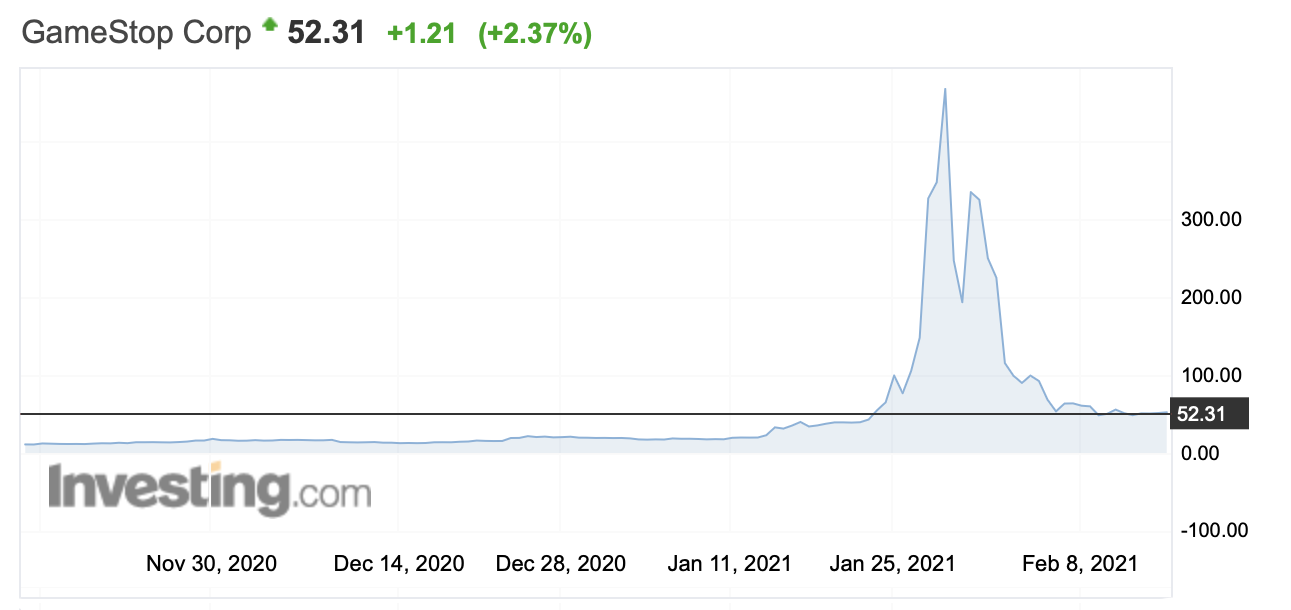

False. The squeeze already happened. From Jan 11 to Jan 27 the stock price rose from $19.94 to $347.51 for an astonishing 1,642% gain before sinking back toward natural levels. That price action is fully indicative of a short squeeze.

A chart showing the short squeeze and resulting selloff

"But short interest is still above 100%"

FINRA only requires short interest data to be reported twice a month. Just because a free financial data website shows over 100% short interest, doesn’t mean that it’s currently at that level. Hedge funds likely closed their short positions on the way up while taking huge losses.

"But not enough volume has traded for shorts to exit"

Short interest data indicates that on Jan 15, 121% of the approximately 70 million shares outstanding had been sold short. Yet, from Jan 19 through Jan 29 nearly 921 million shares were traded according to exchange volume data. The number of shares traded was amply sufficient for short sellers to cover their positions. Additionally, some may have covered using off-exchange transactions which don’t report volume data.

Myth: This is a David vs Goliath story

Mostly false. This was a David and Buy-side Goliath vs Sell-side Goliath on the way up. Retail traders weren’t alone in buying on the way up. There were large, institutional investors behind the little guys. Michael Burry’s Scion Asset Management made upwards of $270 million and Senvest Management made nearly $700 million. There are surely others who have yet to disclose their profits.

On the way down, however, this probably is a David vs Goliath story. Except in this version, David is forced to retreat and regroup.

Myth: Robinhood killed the squeeze

False. The rationale here is simple: if there was money to be made from buying GME above $300, other traders would have bought it. The market is enormous. There are plenty of savvy traders with access to large amounts of capital who don’t use Robinhood to trade.

Ironically, Robinhood’s Jan 28 trading restrictions likely saved many of their clients a lot of money. Inexperienced traders tend to lose money during speculative manias. Robinhood probably stopped several of them from entering bad trades.

This isn’t to say that Robinhood acted perfectly. They are facing broad industry criticism for failing to identify risks ahead of time and reacting too slowly.

Claim: This is about sending a message

Partially true. Over the duration of the GME short squeeze, hedge funds lost around 70 billion on short positions spread over dozens of other stocks. Short sellers will almost certainly remember this episode when considering how much leverage to use in the future. Even if hedge funds don’t learn any lessons, the SEC may further tighten short selling regulations.

"I don’t even care about the money, this is a protest"

Many retail traders who are stubbornly holding losing positions continue to make this claim. Say what one will about big Wall Street banks and hedge funds, but at least they aren’t in the business of throwing their clients’ money away.

Nevertheless, some traders are in considerable distress as a result of losses. We encourage them to seek help and support.

Understanding the difference between trading and investing is crucial. Proper investment management avoids silly speculation like this.