As active investment advisors, we’re always scanning the horizon for the next significant economic shift. But what if that shift is not just figurative, but literal – a shift in weather patterns? As we sail through the choppy seas of global finance, there’s a climate phenomenon on the horizon that could make waves in the stock market: El Niño. Could El Niño put a downward pressure system on the stock market? And with forecasts of a potential recession due to recent interest rate hikes, we’re left wondering if this year’s weather be the trigger.

El Niño: More than just bad weather

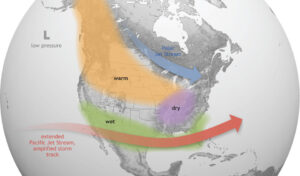

El Niño is a climate pattern that occurs when the Pacific Ocean’s temperature rises above average. This leads to a shift in climate patterns potentially causing severe weather events worldwide. Historically these have included droughts, floods, and hurricanes. Extreme weather events can have significant economic implications, affecting industries a wide variety of industries.

- Farming: El Niño shakes up rainfall, leading to potential crop failures and fluctuating prices for agricultural goods, like palm oil and soybeans.

- Energy: Warmer winters caused by El Niño lessen the need for heating oil, which often causes a dip in oil and gas prices, affecting energy companies.

- Insurance: Wild weather like storms and floods, often linked to El Niño, results in more insurance claims, making life tough for insurance firms.

- Shopping: Odd weather changes people’s shopping habits. A warm winter, for instance, could mean fewer coat sales and a hit for clothing stores.

- Fishing: El Niño influences fish populations, causing trouble for the fishing industry. Countries heavily reliant on fishing, like Peru, feel the pinch.

- Tourism: Unpredictable weather makes some tourist spots less appealing. Think of a ski resort with no snow – bad news for local businesses and tourism-related companies.

In April, the National Weather Service issued an El Niño watch for 2023. There’s a 62% chance it could develop between May and July. This might not sound alarming, but historical models were developed using a climate that hasn’t warmed as much.

Case Study: El Niño 1997-1998

Considered one of the most powerful El Niño events in recorded history, the 1997-1998 phenomenon caused significant disruptions worldwide. The US agriculture sector faced poor harvest due to extreme weather conditions. This was particularly true in California where torrential rain caused flooding and mudslides.

However, warmer winter temperatures reduced heating demand, leading to lower energy costs. Natural gas stocks took a hit as a result. Conversely, companies in the home improvement sector, such as Home Depot and Lowe’s, saw increased sales due to repair and rebuilding efforts after severe weather damages.

Amplifying current market risks

In the current economic landscape, slowing growth and higher interest rates may keep a lid on the stock market. The Federal Reserve’s rate hikes may further squeeze spending and hinder capital investment. Added to this are the fears of inflation and geopolitical upheaval, which may cause further investor anxiety.

The wild card here is El Niño. Extreme weather could amplify these market vulnerabilities and turn a recovery into a bear market. For example, agricultural losses might inflate food prices, significantly adding to consumer inflation. A drop in energy prices due to reduced heating demand could impact fragile energy companies. Moreover, insurance companies, already burdened with costly borrowing, could face more weather-related claims.

Conclusion: Riding out the storm

Investors shouldn’t forget the potential for climate events to disrupt the economy. Extreme weather can cause a ripple effect, influencing everything from agricultural yields to energy consumption and insurance claims. El Niño has the potential to exacerbate existing market vulnerabilities. With the US economy balancing on a tightrope of interest rates, inflation, and geopolitical unease, El Niño could be the gust of wind that tips the scales. Investors should take care and consider battening down the hatches in anticipation of rough seas ahead.