Restricted stock units can transform your financial picture overnight. One day you’re earning a salary. The next day you’re holding thousands of dollars in company stock. This windfall creates opportunities most people never expected. It also creates investment challenges that catch many employees off guard.

RSUs represent real money with real tax consequences. They affect your investment portfolio in ways that go far beyond their dollar value. The decisions you make about your RSUs will influence your financial future for years to come. Understanding how to integrate these assets into your broader investment strategy becomes crucial for long-term wealth building.

This article walks through the key considerations for RSU investing. We’ll cover how RSUs work, their tax implications, concentration risks, and strategic approaches to managing them within your overall portfolio.

How RSUs Work

Restricted stock units are company shares given to employees as compensation. The company grants you a specific number of shares that become yours over time. This process is called vesting. You don’t own the shares immediately. Instead, you earn them according to a predetermined schedule.

Many RSU grants follow a four-year vesting schedule. Companies typically use either annual vesting or quarterly vesting. With annual vesting, 25% of your shares vest each year for four years. Quarterly vesting gives you smaller portions every three months. Some companies front-load vesting or use different schedules entirely.

Consider a software engineer who receives 400 RSUs with a four-year annual vesting schedule. She gets 100 shares after year one, another 100 after year two, and so on. If the stock trades at $200 per share, each vesting event puts $20,000 worth of stock in her account.

RSUs differ from stock options in important ways. Stock options give you the right to buy shares at a fixed price. RSUs give you actual shares once they vest. You don’t pay anything to receive RSUs. The shares simply appear in your brokerage account on the vesting date.

This “free money” feeling makes RSUs psychologically different from other investments. You didn’t write a check to buy these shares. You earned them through your work. This emotional connection can influence your investment decisions in ways that may not serve your long-term interests.

Tax Consequences of RSUs

The IRS treats RSU vesting as ordinary income. When shares vest, their full market value gets added to your taxable income for that year. This happens regardless of whether you sell the shares or keep them. The tax bill arrives whether you convert the stock to cash or not.

Your employer withholds taxes when RSUs vest, but the withholding often falls short. Federal withholding on supplemental income like RSUs typically runs 22%. If you’re in a higher tax bracket, you’ll owe additional taxes when you file your return. State taxes add another layer of complexity, especially if you work remotely for a company based in a different state.

Imagine an employee whose $100,000 worth of RSUs vest in a single year. This vesting adds $100,000 to his taxable income. If he’s already in the 32% federal tax bracket, he owes $32,000 in federal taxes plus state taxes. His employer might withhold only $22,000, leaving him with a $10,000+ surprise tax bill.

The tax consequences don’t end at vesting. When you eventually sell RSU shares, you’ll face capital gains taxes on any appreciation since the vesting date. If the stock price rose from $200 to $250 between vesting and selling, that $50 per share gain triggers capital gains taxes.

Timing becomes critical for tax planning. Large vesting events can push you into higher tax brackets. They can also affect your eligibility for certain tax benefits and deductions. Some employees find themselves owing estimated taxes for the first time in their lives.

RSU Concentration Risk Explained

Concentration risk occurs when too much of your wealth depends on a single investment. RSUs create concentration risk by tying a large portion of your assets to one company’s stock performance. This risk becomes amplified because the same company provides your paycheck and your equity compensation.

Your financial wellbeing becomes tied to your employer’s success in multiple ways. If the company struggles, your job security and your investment portfolio both suffer simultaneously. You can’t diversify away the employment risk, but you can address the investment concentration.

Consider what happened to employees at the numerous companies that failed when the dot-com bubble burst. Many lost their jobs at the same time their stock portfolios crashed. This double impact devastated families who had become too dependent on their employer’s success.

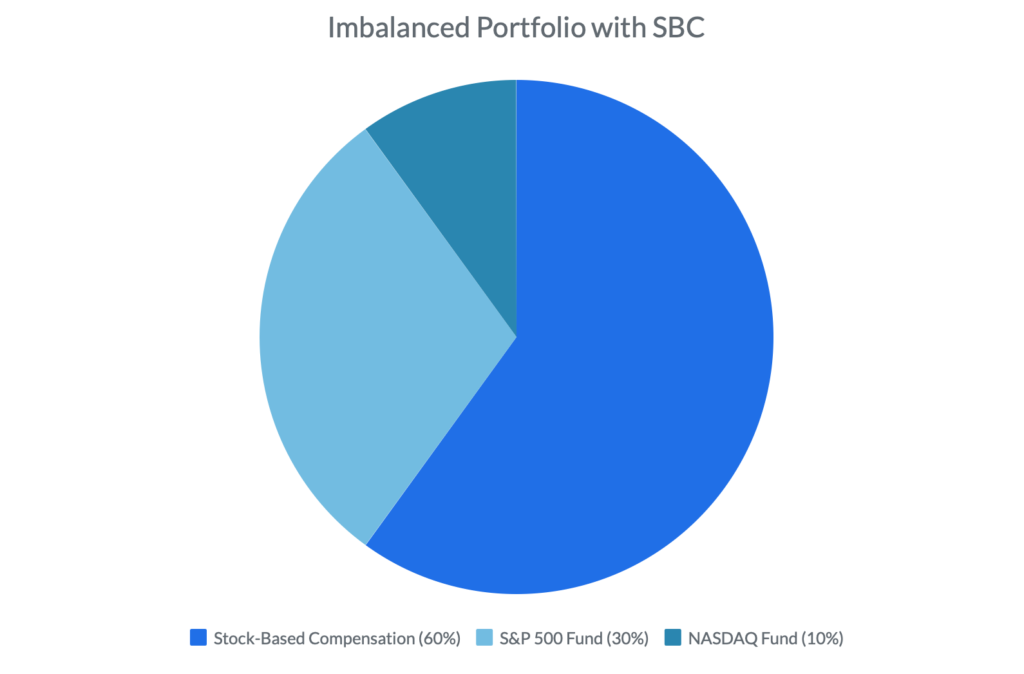

The appropriate level of concentration depends on your specific situation. A good rule of thumb is limit any single stock to 5-10% of your total investment portfolio. Even the SEC recommends holding at least a dozen stocks, presumably in similar proportions. However, RSUs can quickly push your company stock well beyond these guidelines, especially at fast-growing companies where stock appreciation outpaces your ability to diversify.

Concentration risk also affects your investment timeline. You might feel comfortable holding a concentrated position for a few years, but maintaining that concentration for decades increases your long-term risk. The longer you hold a concentrated position, the more likely you are to experience a significant downturn in that investment.

Investment Strategies for RSUs

Managing RSUs requires balancing multiple competing priorities. You want to capture the upside potential of your company’s growth while managing concentration risk and tax consequences. The optimal approach varies based on your overall financial situation, investment timeline, and risk tolerance.

Some investors sell RSUs immediately upon vesting. This strategy provides maximum diversification and eliminates concentration risk quickly. You can reinvest the proceeds across a broader range of assets that align with your investment objectives. Immediate selling also provides certainty about your tax obligations and available cash.

Other investors hold RSUs for longer periods to capture potential appreciation. This approach makes sense if you believe strongly in your company’s prospects and can tolerate the concentration risk. Holding also incurs capital gains taxes when you choose to sell.

The decision often depends on your existing portfolio composition. If RSUs represent a small portion of your total investments, holding them may be reasonable. If they dominate your net worth, diversification becomes more urgent.

Your investment strategy should also account for future RSU grants. Many employees receive annual refresher grants that create ongoing vesting events. Planning for these future vesting events helps you maintain appropriate diversification over time.

Integration with your broader financial plan matters enormously. RSUs might fund major life goals like home purchases or retirement savings. They might provide the foundation for more aggressive investing in other areas since you already have significant equity exposure through your employer.

Consider how RSUs interact with your other investments. If you’re investing heavily in technology funds or growth stocks, adding more company stock increases your overall concentration in similar assets. Alternatively, if your broader portfolio focuses on conservative investments, some company stock exposure might provide beneficial growth potential.

Conclusion

Professional guidance becomes valuable when coordinating these various elements. The tax implications, concentration risk management, and portfolio integration require careful analysis of your specific situation. Generic investment advice rarely addresses the unique challenges that RSUs create.

RSU investing involves more complexity than most people initially realize. The tax consequences extend beyond simple withholding at vesting. Concentration risk affects both your investment portfolio and your overall financial security. Strategic decisions about when to sell and how to reinvest proceeds can significantly impact your long-term wealth.

The right approach depends entirely on your individual circumstances. Your existing investments, financial goals, tax situation, and risk tolerance all influence the optimal RSU strategy. These decisions become even more important as your RSU grants accumulate over multiple years.

Ready to see if our approach aligns with your needs? Our quick 4-question assessment helps determine if we might be a good fit for your situation. Start here to begin the conversation.