Picture this: You’re in your mid 40s, sipping a cocktail on a beautiful beach, without a care in the world. No, you haven’t won the lottery – you’ve achieved FIRE (Financial Independence, Retire Early). FIRE is a growing movement that encourages aggressive saving and investing to achieve financial freedom and retire well before the traditional retirement age. The key to making this dream a reality? Smart investing strategies that put your money to work for you. In this article, we’ll explore the best investing approaches to help you reach FIRE faster than you ever thought possible.

1) The importance of starting early

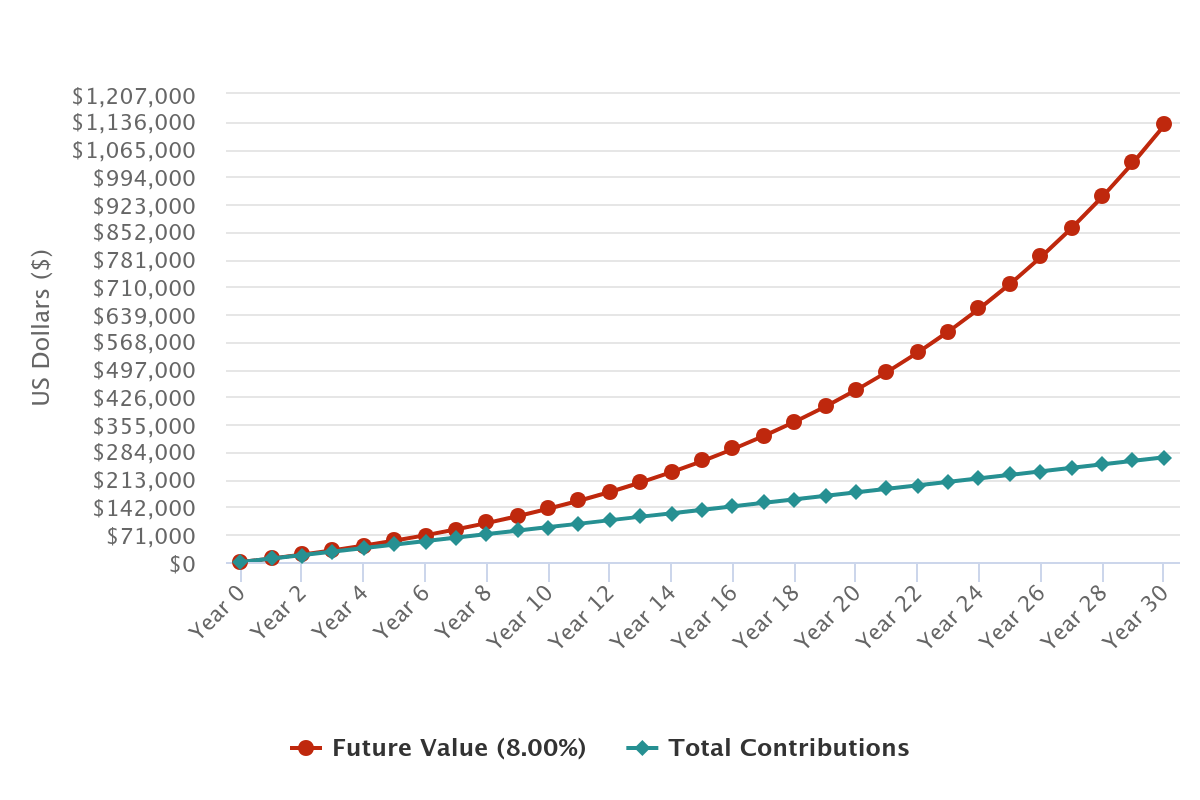

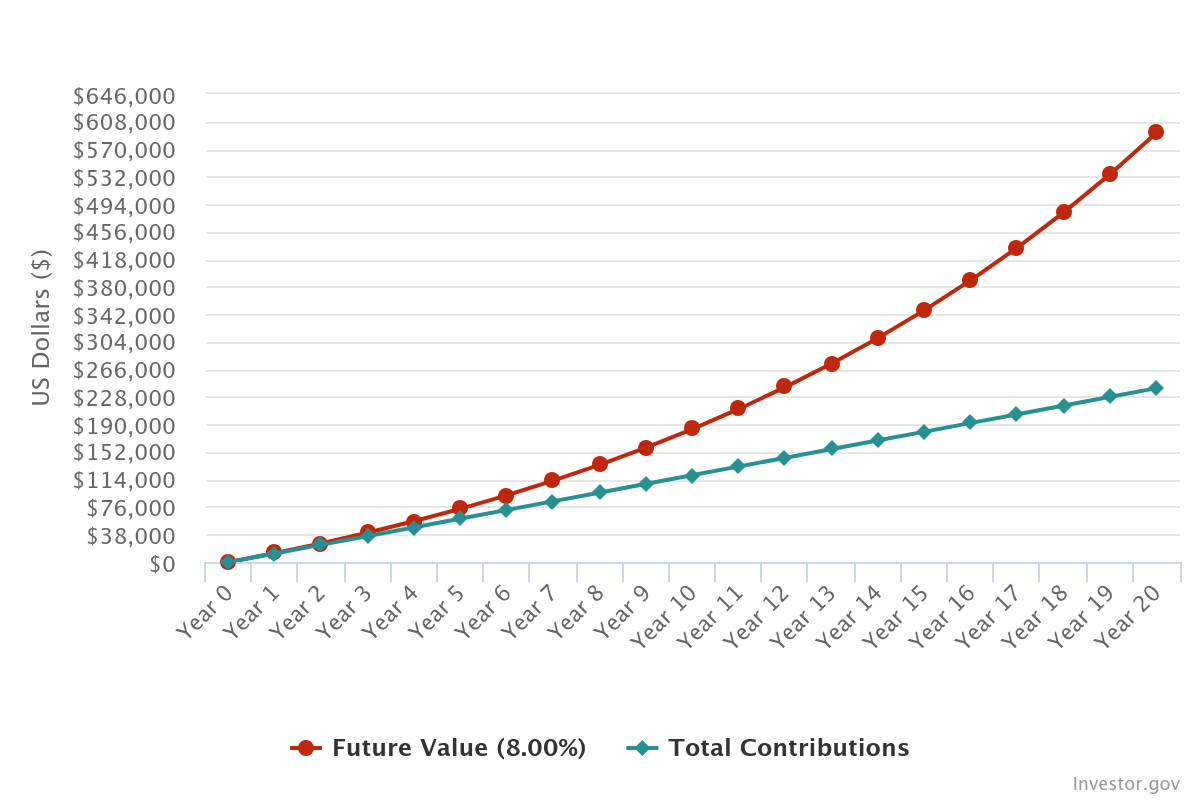

When it comes to achieving FIRE, the earlier you start investing, the better. The power of compound interest means that your money grows exponentially over time, so even small contributions can make a huge impact if you start early enough. For example, if you begin investing $750 per month at age 25 with an average annual return of 8%, you could have over $1.1 million by age 55. But if you wait until 35 to start, you’d have less than $600,000 even if you increase savings to $1000 per month. The lesson? Start investing as early as possible to give your money the most time to grow.

$1,127,281.27

Saving $750 per month for 30 years

$592,824.62

Saving $1000 per month for 20 years

2) Asset allocation for FIRE

To achieve FIRE, you’ll need to be willing to take on more risk than the average investor. This means allocating a larger portion of your portfolio to stocks, which have historically provided higher returns than bonds or other conservative investments. However, with higher potential returns comes increased risk, so it’s important to make sure you’re comfortable with the level of risk you’re taking on. Work with an investment advisor to create an asset allocation that aligns with your risk tolerance and FIRE timeline.

3) Tax optimization strategies

One of the smartest moves you can make as a FIRE investor is to maximize your use of tax-advantaged accounts like 401(k)s, IRAs, and HSAs. These accounts offer tax benefits that can help you save more money and reduce your overall tax liability. However, it’s important to keep in mind that many traditional retirement accounts have penalties for withdrawing funds before age 59½.

This is where the Roth IRA comes in. Unlike traditional IRAs, Roth IRA contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. Plus, Roth IRA holders can withdraw their contributions (but not earnings) at any time without penalty. This can be a valuable strategy for FIRE investors who may need to access some of their funds before reaching traditional retirement age. However, keep in mind that earnings withdrawn from a Roth IRA before age 59½ and before the account has been open for five years may be subject to taxes and penalties.

4) Active investing for FIRE

While passive index investing has gained popularity recently, active management offers the potential to outperform passive strategies. With active management, professional fund managers make strategic investment decisions based on market research and analysis, with the goal of beating market returns. And when it comes to investing, you often get what you pay for – by working with experienced professionals, you may be able to achieve better results than simply investing in index funds. Of course, active management often comes with higher risks than passive investing, so it’s important to work with a Registered Investment Adviser (RIA) firm to determine if active management makes sense for your FIRE goals.

5) Alternative investments for FIRE

For FIRE investors who are willing to take on more risk in pursuit of higher returns, alternative investments like real estate or private equity can be a smart addition to a diversified portfolio. These types of investments have the potential to generate strong returns and provide diversification beyond traditional stocks and bonds. However, it’s important to approach alternative investments with caution, as they can be highly illiquid and come with significant risk. Work closely with your investment advisor to determine if alternative investments are a good fit for your FIRE strategy.

6) The 4% rule and safe withdrawal rates

The 4% rule is a widely-used guideline for determining how much you can safely withdraw from your retirement portfolio each year without running out of money. The rule suggests that retirees can withdraw 4% of their initial retirement portfolio balance each year, adjusted for inflation, and have a high probability of not running out of money over a 30-year retirement.

However, the 4% rule may not be suitable for everyone, especially those pursuing FIRE with longer retirement horizons. To use the 4% rule, you’ll need to accumulate a portfolio that is 25 times your annual expenses. For example, if you need $40,000 per year to live on, you’ll need a portfolio of at least $1 million ($40,000 x 25) to safely withdraw 4% each year. Work with your financial advisor to determine a safe withdrawal rate and portfolio target that aligns with your specific FIRE goals and retirement timeline.

7) Lifestyle design and budgeting for FIRE

Investing is just one piece of the FIRE puzzle – achieving financial independence also requires designing a lifestyle that aligns with your goals. This means creating a budget that supports aggressive saving and investing. Look for ways to reduce expenses and increase your savings rate, whether that means downsizing your home, cutting back on dining out, or finding ways to increase your income through side hustles or freelance work. The higher your savings rate, the faster you can reach FIRE.

8) Staying the course during market volatility

One of the biggest challenges of investing for FIRE is staying the course during market ups and downs. When the market is volatile, it can be tempting to make emotional decisions and sell off investments out of fear. However, this can be a costly mistake. Remember that short-term market movements are normal, and historically, markets have always recovered from downturns. Stick to your long-term investment plan and avoid making impulsive decisions based on short-term market movements. Regular check-ins with your investment advisor can help you stay focused on your FIRE goals and make informed decisions during market turbulence.

9) Working with an investment advisor

Pursuing FIRE is not a one-size-fits-all journey, which is why working with a Registered Investment Adviser (RIA) firm can be so valuable. An experienced advisor can help you create a personalized investment strategy tailored to your unique FIRE goals, risk tolerance, and time horizon. They can provide guidance on asset allocation, tax optimization, retirement account management, and more, and offer ongoing support and advice to help you stay on track as your life and financial situation evolve.

Conclusion: Investing for FIRE — Start your journey

Investing for FIRE is not for the faint of heart – it requires discipline, a long-term perspective, and a willingness to take on more risk in pursuit of your dreams. But by starting early, optimizing your asset allocation and tax strategy, considering alternative investments, and working with a trusted financial advisor, you can accelerate your path to financial independence and early retirement. Remember, FIRE is not just about the destination – it’s about designing a life that aligns with your values and priorities. So dream big, stay the course, and never stop believing in your ability to achieve financial freedom on your own terms.

If you’re ready to take bold steps towards achieving FIRE, we invite you to contact our experienced advisors for a consultation. Our professionals are passionate about helping driven individuals like you turn their FIRE dreams into reality. Together, we can create a powerful investment strategy to help you reach financial independence faster than you ever thought possible. So let’s get started – your dream life awaits!