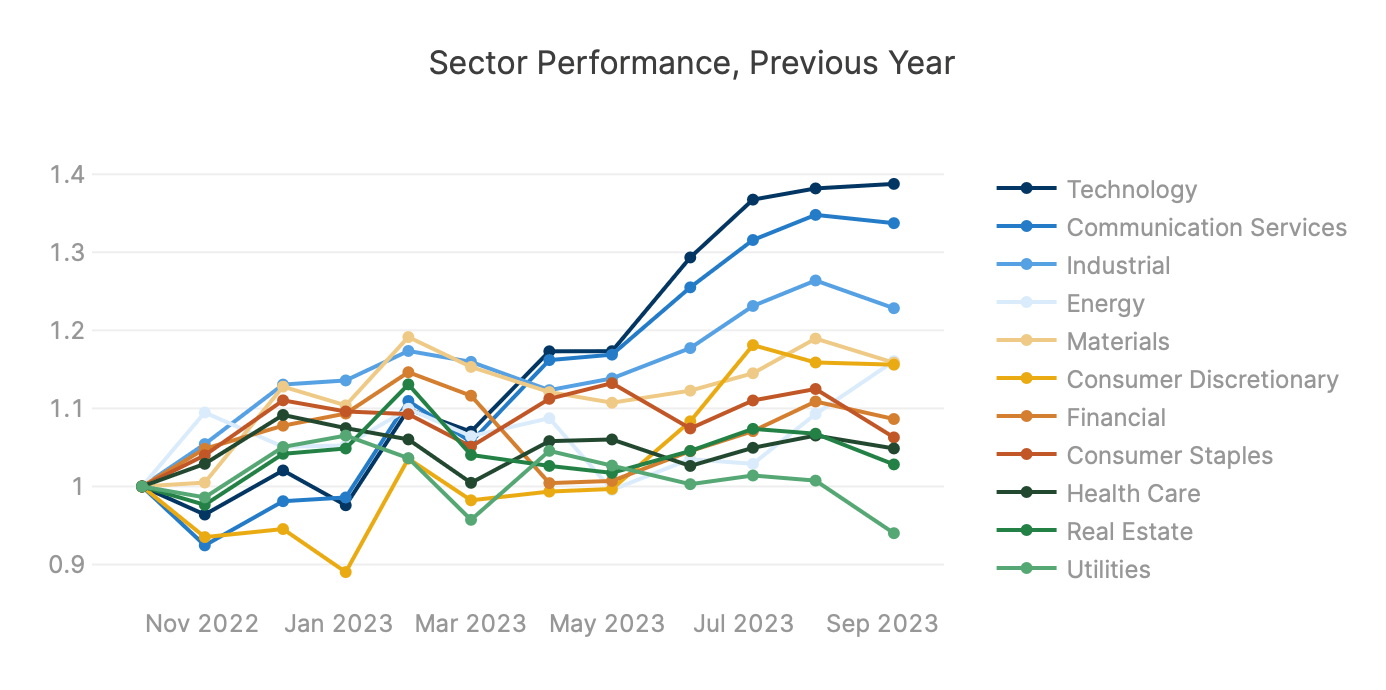

Over the past year, the 7 biggest US companies (all technology-related) have performed stunningly compared to the rest of the market. We identify 2 reasons why. First, these stocks are benefiting from euphoria relating to AI. It’s still very early in this industry, and it’s reminiscent of the internet in 1996. No one knows exactly which technology companies will best realize this opportunity, but today the bets are on the winners from the past decade. Secondly, these stocks were among the hardest hit during the 2022 bear market, thus providing the foundation for a stronger recovery. It can be baffling that the biggest investments are also among the most volatile.

The economy appears to be marching ever closer to recession. Leading economic indicators remain depressed, signaling a recession. Housing affordability is the worst it’s been since the 1980s due to aggressive interest rate hikes by the Federal Reserve. And there are signs of weakening consumer demand. However, these effects do not appear to have flowed through to the business cycle just yet. I recall from my studies that it may take 3 quarters for interest rate policy to affect the real economy. It’s worth noting that the Fed raised rates as recently as July. Inflation has moderated, which may mean some relief from the central bank. Although energy prices are on the rise, the Fed tends to overlook food and energy inflation due to their volatility.

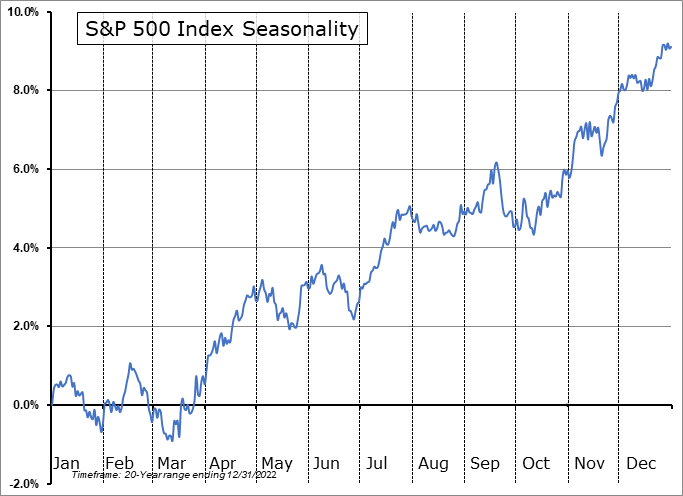

We’re entering a historically strong season for the market. Historically, stocks tend to rise during the second half of October through December. Of course past performance does not guarantee future performance. Given the aforementioned headwinds, we’re expecting the coming season to be relatively flat. We continue to focus on selecting stocks with a margin of safety as well as favorable long-term growth prospects. We strive to avoid hype and fickle trends.

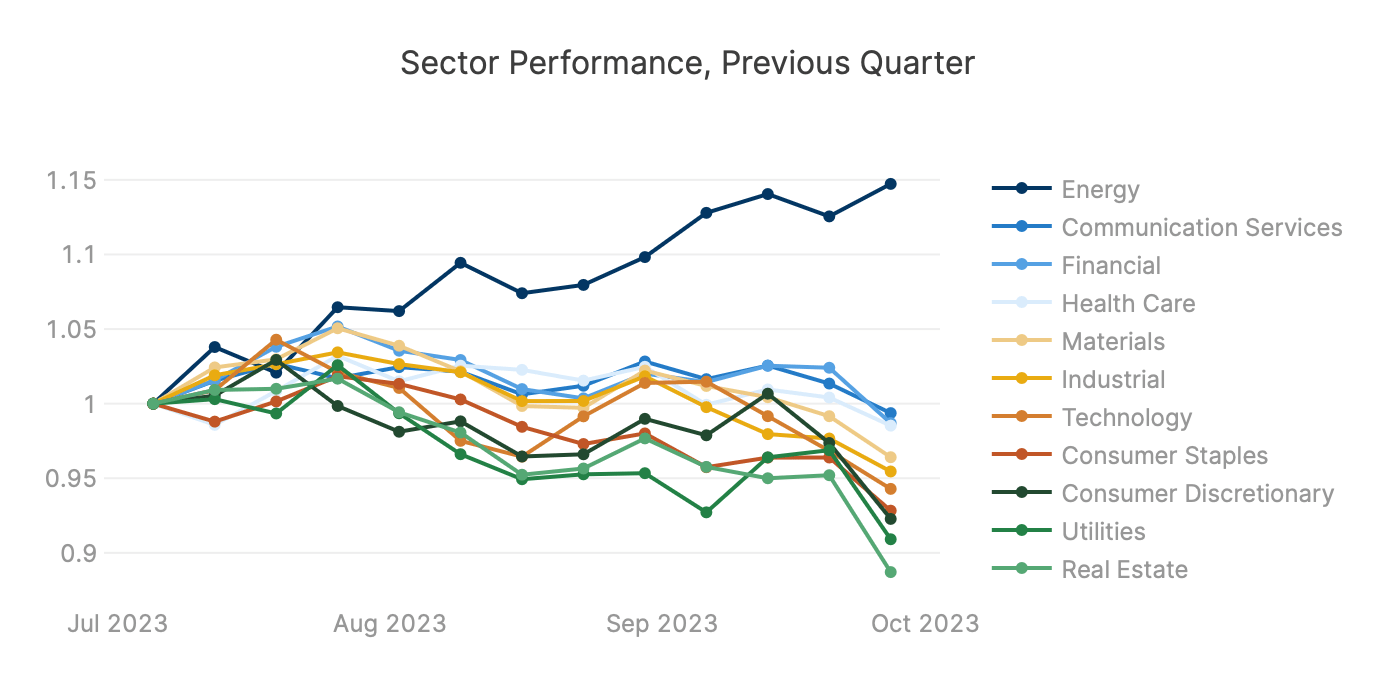

Stock Performance by Category

In Q3, energy was bolstered by a resilient US economy and oil supply cuts by Russia and Saudi Arabia. A reversal of these factors is a continuing risk for the sector.

The technology and communication services indices are heavily skewed by the 7 megacap companies. AAPL and MSFT represent over 40% of technology, and META and GOOG are over 40% of communications services.

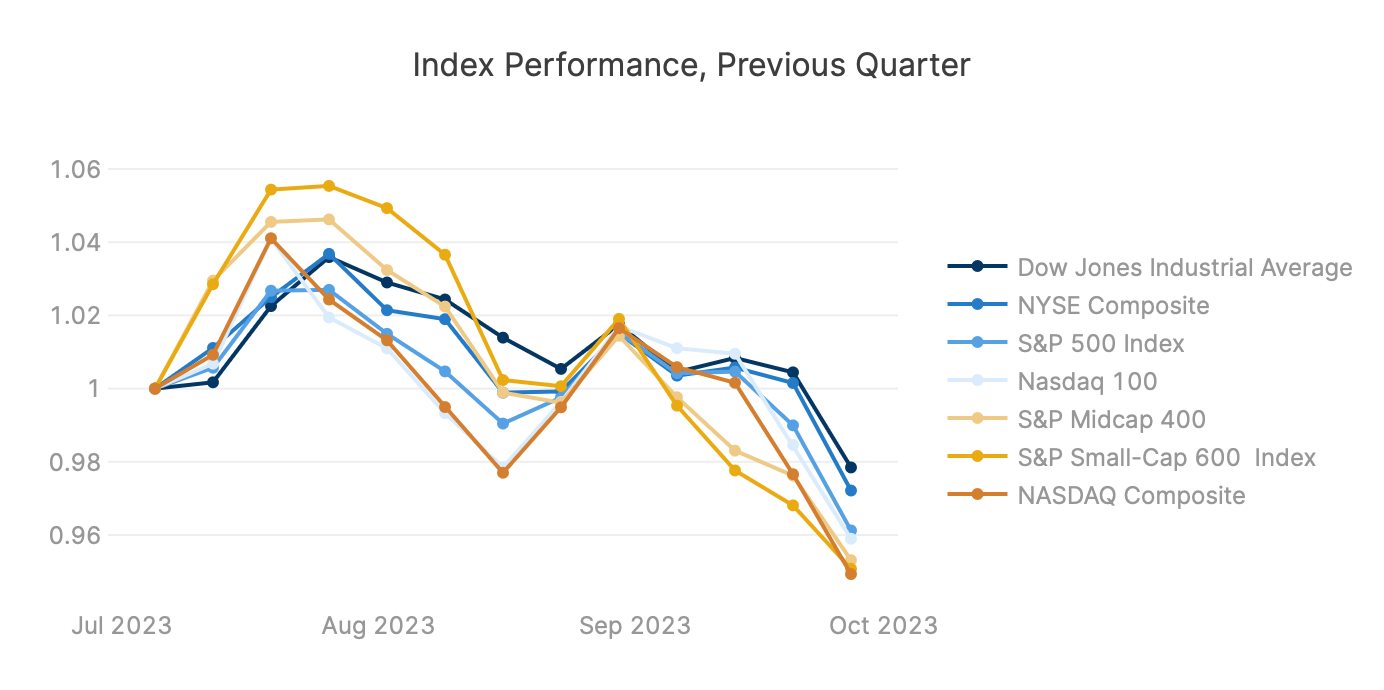

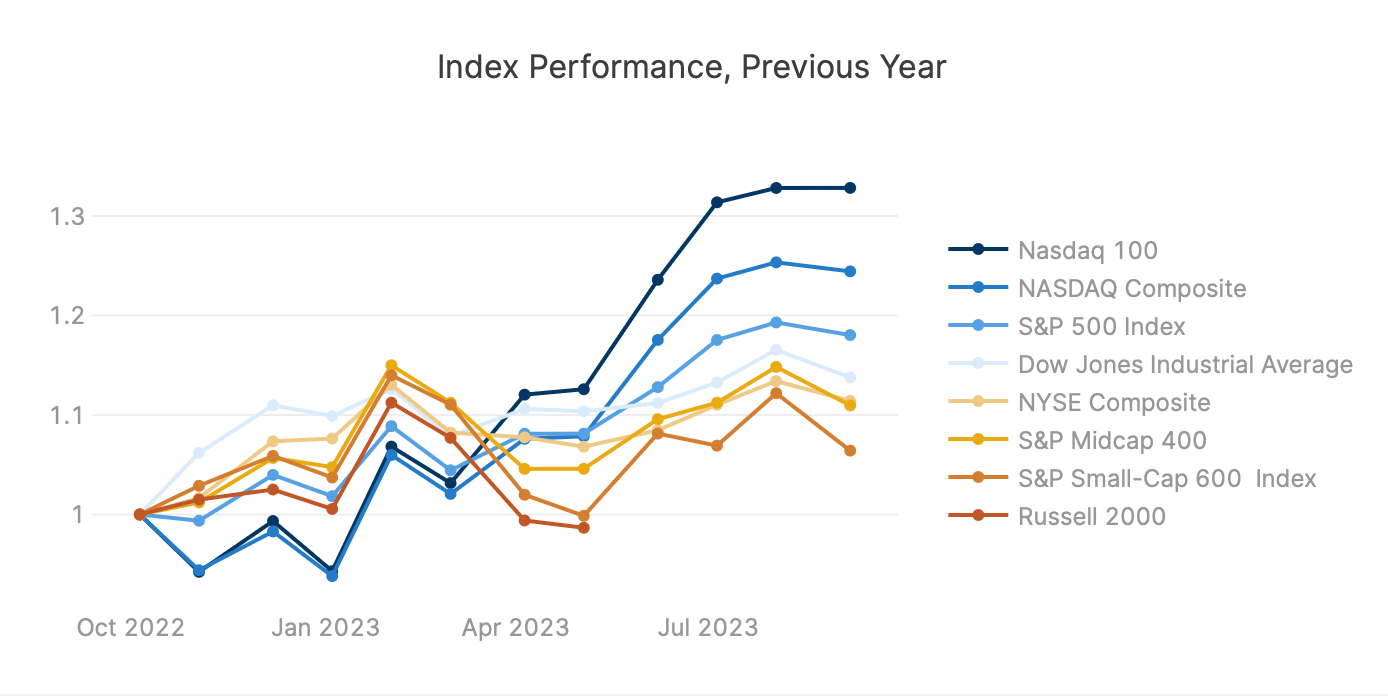

Indices were mostly correlated with early Small Cap outperformance reversing toward the end of the quarter.

The NASDAQ 100 is the big winner in 2023 as enthusiasm about AI continues to benefit the megacap tech companies. These few companies represent an outsize share of US stock valuation and tend to skew indices with few stocks, such as the NASDAQ 100 or DOW 30.