Tariffs roil markets and the economy

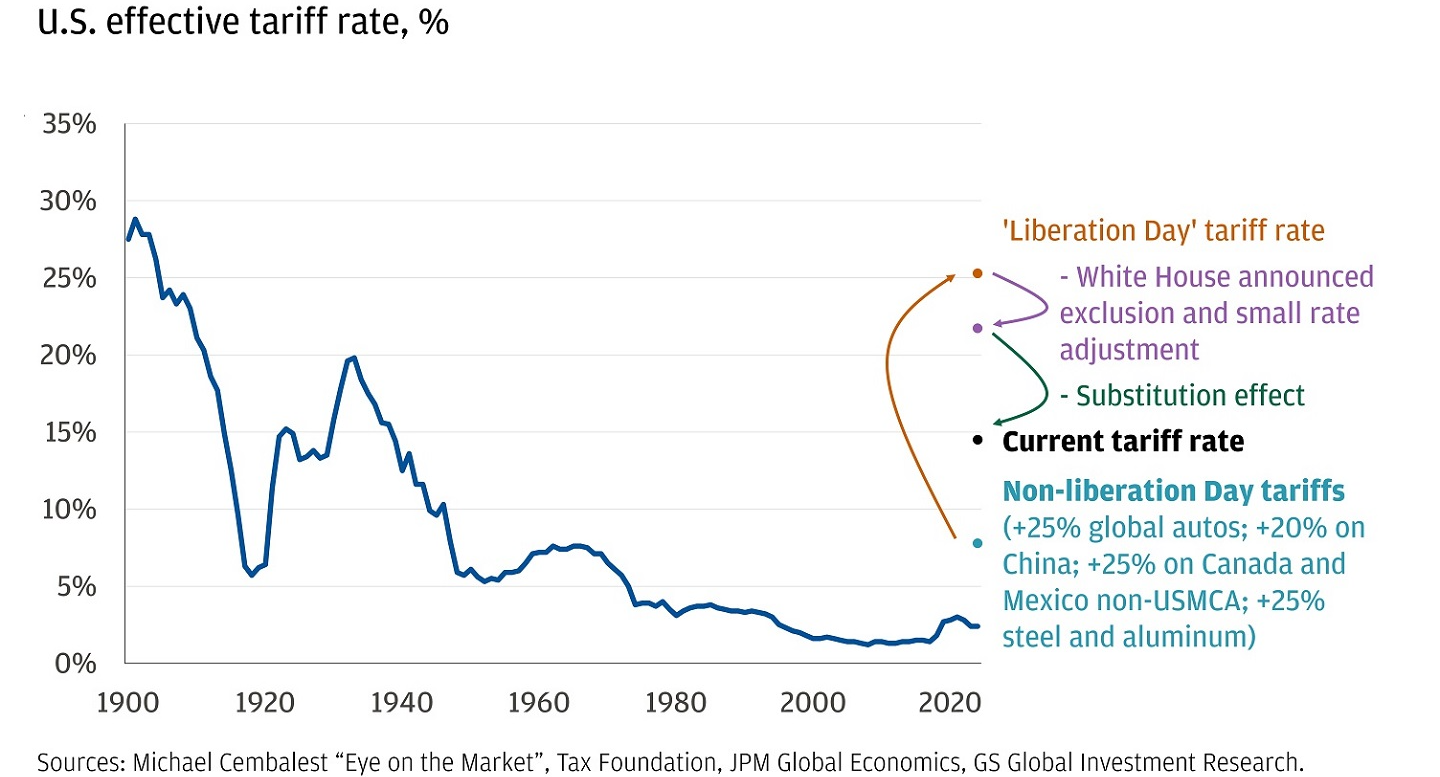

The Trump administration’s action involving tariffs have resulted in much volatility in the markets. As of inauguration day, Wall Street appeared to believe that Trump’s tariff rhetoric was simply a negotiating tactic or otherwise immaterial political speech. This changed in March when he allowed tariffs on Canada and Mexico to actually take effect. In response to this event, we took steps to reduce client stock exposure to below our default target. Subsequently, a massive set of tariffs was announced in April, and the market reaction was historic.

Much uncertainty remains about the tariff situation. The April 2nd tariff announcement included a 10% general tariff, a penalty tariff on countries with a trade surplus vs the US, and promises for retaliatory tariffs. China retaliated which caused a tit-for-tat escalation to the point where bilateral trade is grinding to a halt. Markets quickly understood that this situation is untenable, and Trump attempted damage control by delaying the penalty tariffs, and calling for negotiations including with China. Our assessment is that the Trump administration’s nearterm goal is to implement the 10% general tariff, plus some additional tariffs on China. We think the intention is to negotiate away penalty tariffs without too much trouble. It appears that the market agrees, having rallied back towards its April 1st level amid much volatility. However, it is certainly a possibility that deals are not made easily, and worse-than-expected tariffs begin to take effect.

We advise bracing for a recession. Tariffs are tantamount to a sales tax. (In fact, some companies are already itemizing tariffs on sales receipts much like sales tax.) A sudden 10% or more price hike is a large shock to any economy. Our view is that, ultimately the economy can adjust to a one-time 10% tariff and resume growth. However, the chaotic nature of the tariff announcements makes it extremely difficult for businesses and consumers to plan their spending and investment. When everyone starts playing defense, that reduces economic activity even more. We are expecting a recession that may require fiscal and/or monetary stimulus depending on the path this tariff situation takes.

Market Commentary: 2025 Q2

Tariffs roil markets and the economy

The Trump administration’s action involving tariffs have resulted in much volatility in the markets. As of inauguration day, Wall Street appeared to believe that Trump’s tariff rhetoric was simply a negotiating tactic or otherwise immaterial political speech. This changed in March when he allowed tariffs on Canada and Mexico to actually take effect. In response to this event, we took steps to reduce client stock exposure to below our default target. Subsequently, a massive set of tariffs was announced in April, and the market reaction was historic.

Much uncertainty remains about the tariff situation. The April 2nd tariff announcement included a 10% general tariff, a penalty tariff on countries with a trade surplus vs the US, and promises for retaliatory tariffs. China retaliated which caused a tit-for-tat escalation to the point where bilateral trade is grinding to a halt. Markets quickly understood that this situation is untenable, and Trump attempted damage control by delaying the penalty tariffs, and calling for negotiations including with China. Our assessment is that the Trump administration’s nearterm goal is to implement the 10% general tariff, plus some additional tariffs on China. We think the intention is to negotiate away penalty tariffs without too much trouble. It appears that the market agrees, having rallied back towards its April 1st level amid much volatility. However, it is certainly a possibility that deals are not made easily, and worse-than-expected tariffs begin to take effect.

We advise bracing for a recession. Tariffs are tantamount to a sales tax. (In fact, some companies are already itemizing tariffs on sales receipts much like sales tax.) A sudden 10% or more price hike is a large shock to any economy. Our view is that, ultimately the economy can adjust to a one-time 10% tariff and resume growth. However, the chaotic nature of the tariff announcements makes it extremely difficult for businesses and consumers to plan their spending and investment. When everyone starts playing defense, that reduces economic activity even more. We are expecting a recession that may require fiscal and/or monetary stimulus depending on the path this tariff situation takes.

Get insights delivered to your inbox and never miss our latest research and key developments. Our monthly roundup includes analysis, updates, and other resources for serious investors.

Related Posts

Market Commentary: 2026 Q1

Seven Warren Buffett gold quotes every investor should understand

16 of the Worst Investments in History: How to Avoid the Next One

Share This Story

Are we right for you?

Take our brief survey to learn if our advisory services are the best match for your financial goals and situation, and see if we should move forward together.

Ready for the first step?

Schedule a no-cost consultation to discuss your financial goals and explore how we can help you build a personalized investment strategy.