A Volatile Time for Hard Assets

Gold touched an all-time high near $5,600 per ounce on January 29 before suffering its worst single-day decline since the 1980s, falling more than 12% the following day. The catalyst was President Trump’s nomination of former Fed Governor Kevin Warsh to succeed Jerome Powell as Federal Reserve Chair. Markets view Warsh as a more hawkish choice, unlikely to aggressively cut rates, and the anti-dollar trade unwound quickly.

Silver’s collapse was even more dramatic. After touching $120 per ounce, nearly four times its price at Trump’s second inauguration, it crashed more than 30% on January 30 in its worst single day ever recorded. Silver has a long history of amplifying gold’s moves in both directions, and this episode was no exception. When gold rallies, it attracts attention. But at $5,000 per ounce, many smaller investors feel priced out and turn to silver as the cheaper way to play the same trade. This is a fallacy. Buying one ounce of silver instead of a fraction of an ounce of gold does not actually provide more exposure to the trade.It gives exposure to a different, smaller, and far more volatile market. The result is that silver tends to attract more speculative capital late in a rally, and this time a wave of Chinese retail buying pushed it into that territory. Commentators compared it to the GameStop frenzy of 2021. When the reversal came, it was predictably severe.

Bitcoin, meanwhile, has been in its own four-month decline from a peak near $126,000 in October to below $65,000 this week, erasing the entirety of the post-election rally. The “digital gold” label has apparently not tested well under pressure.

Legendary investor Warren Buffett has never been a fan of gold, and times like this illustrate why. As he once put it at a Berkshire Hathaway shareholder meeting:

“All you are doing when you buy that is hoping that somebody else a year from now, or five years from now, will pay you more to own something that can’t do anything.”

Buffett’s broader argument, which he has made repeatedly over the years, is straightforward. Gold does not generate income, produce goods, or grow earnings. A business earns profits. Farmland grows crops. Real estate generates rent. Gold just sits there. He has famously said that if you gave him the choice between all the gold in the world and an equivalent value of productive assets, he would take the productive assets without hesitation. That reasoning does not change just because gold briefly touched record highs.

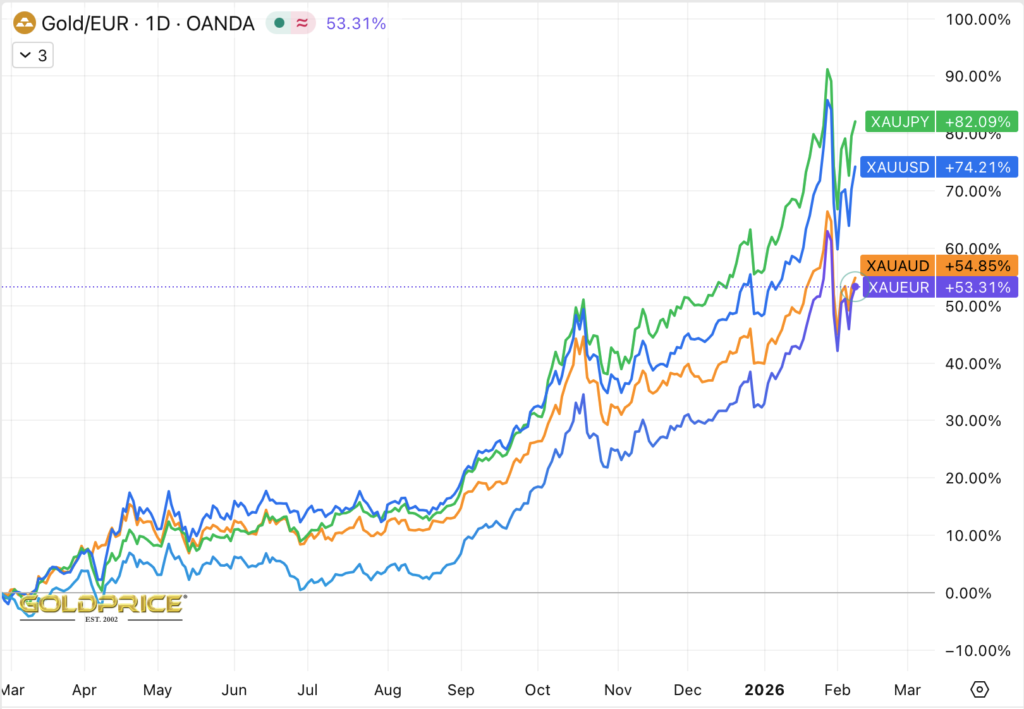

One final observation. Much of the rally in gold, silver, and bitcoin has been framed as a hedge against dollar debasement. The idea that runaway deficits are eroding the value of the greenback makes hard assets a rational trade. There is a reasonable case for that concern. But if dollar debasement were truly the driver, gold should have risen primarily against the dollar. Instead, over the past year gold rose approximately 67% in dollars, 59% in Australian dollars, 44% in euros, and 73% in yen. This was not a dollar story. It was a gold story. Something, whether speculation, central bank buying, or a broader crisis of confidence, drove gold higher against virtually everything. And when the trade reversed, it reversed against everything too.

Gold price as measured in 4 different currencies

Silver/Gold price ratio

Market Commentary: 2026 Q1

A Volatile Time for Hard Assets

Gold touched an all-time high near $5,600 per ounce on January 29 before suffering its worst single-day decline since the 1980s, falling more than 12% the following day. The catalyst was President Trump’s nomination of former Fed Governor Kevin Warsh to succeed Jerome Powell as Federal Reserve Chair. Markets view Warsh as a more hawkish choice, unlikely to aggressively cut rates, and the anti-dollar trade unwound quickly.

Silver’s collapse was even more dramatic. After touching $120 per ounce, nearly four times its price at Trump’s second inauguration, it crashed more than 30% on January 30 in its worst single day ever recorded. Silver has a long history of amplifying gold’s moves in both directions, and this episode was no exception. When gold rallies, it attracts attention. But at $5,000 per ounce, many smaller investors feel priced out and turn to silver as the cheaper way to play the same trade. This is a fallacy. Buying one ounce of silver instead of a fraction of an ounce of gold does not actually provide more exposure to the trade.It gives exposure to a different, smaller, and far more volatile market. The result is that silver tends to attract more speculative capital late in a rally, and this time a wave of Chinese retail buying pushed it into that territory. Commentators compared it to the GameStop frenzy of 2021. When the reversal came, it was predictably severe.

Bitcoin, meanwhile, has been in its own four-month decline from a peak near $126,000 in October to below $65,000 this week, erasing the entirety of the post-election rally. The “digital gold” label has apparently not tested well under pressure.

Legendary investor Warren Buffett has never been a fan of gold, and times like this illustrate why. As he once put it at a Berkshire Hathaway shareholder meeting:

Buffett’s broader argument, which he has made repeatedly over the years, is straightforward. Gold does not generate income, produce goods, or grow earnings. A business earns profits. Farmland grows crops. Real estate generates rent. Gold just sits there. He has famously said that if you gave him the choice between all the gold in the world and an equivalent value of productive assets, he would take the productive assets without hesitation. That reasoning does not change just because gold briefly touched record highs.

One final observation. Much of the rally in gold, silver, and bitcoin has been framed as a hedge against dollar debasement. The idea that runaway deficits are eroding the value of the greenback makes hard assets a rational trade. There is a reasonable case for that concern. But if dollar debasement were truly the driver, gold should have risen primarily against the dollar. Instead, over the past year gold rose approximately 67% in dollars, 59% in Australian dollars, 44% in euros, and 73% in yen. This was not a dollar story. It was a gold story. Something, whether speculation, central bank buying, or a broader crisis of confidence, drove gold higher against virtually everything. And when the trade reversed, it reversed against everything too.

Gold price as measured in 4 different currencies

Silver/Gold price ratio

Get insights delivered to your inbox and never miss our latest research and key developments. Our monthly roundup includes analysis, updates, and other resources for serious investors.

Related Posts

Seven Warren Buffett gold quotes every investor should understand

16 of the Worst Investments in History: How to Avoid the Next One

Circular financing in AI looks a lot like 1929

Share This Story

Are we right for you?

Take our brief survey to learn if our advisory services are the best match for your financial goals and situation, and see if we should move forward together.

Ready for the first step?

Schedule a no-cost consultation to discuss your financial goals and explore how we can help you build a personalized investment strategy.