COMPANY OVERVIEW

Pioneering Brokerage Excellence with Global Reach

Interactive Brokers Group, Inc. (IBKR), founded in 1978 by Thomas Peterffy, is a leading global brokerage firm renowned for its advanced trading technology and low-cost solutions. Initially starting as a market maker on the American Stock Exchange, the company has grown into a major industry player. With a focus on electronic brokerage, Interactive Brokers offers access to over 135 market centers in 33 countries, supporting a wide range of asset classes. Known for its innovation and efficiency, the firm continues to be a top choice for active traders and financial professionals worldwide.

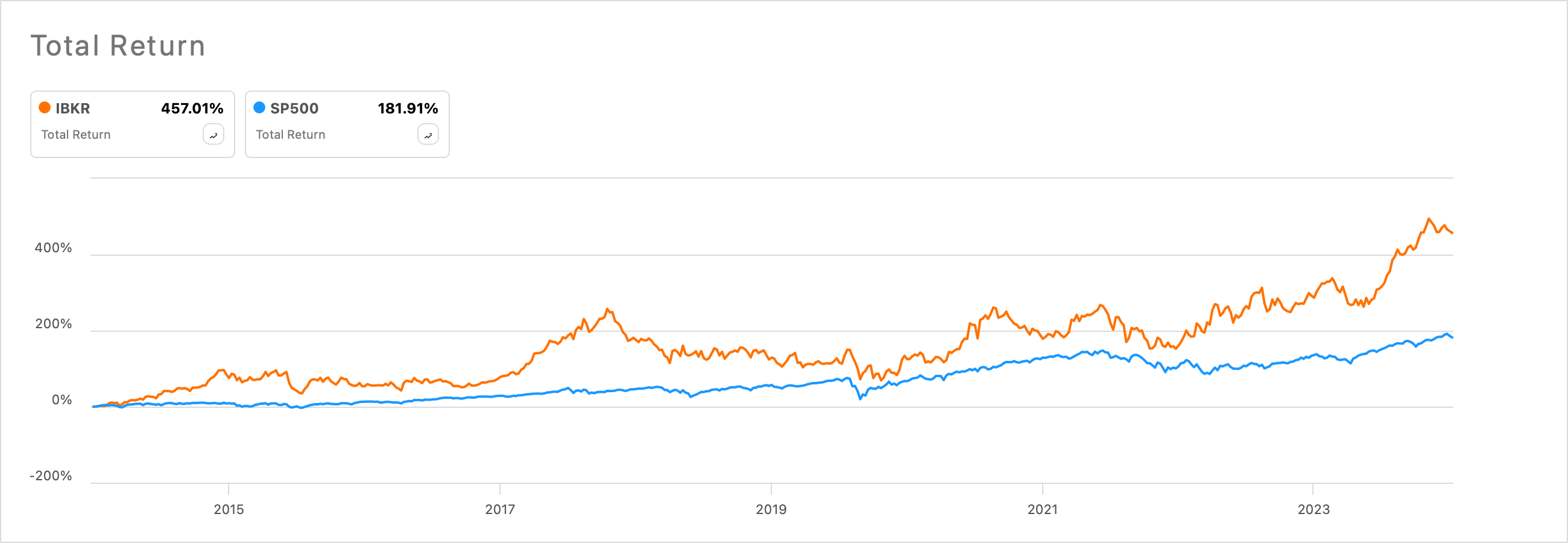

HISTORICAL PERFORMANCE

Healthy Growth and Robust Financial Performance

FINANCIAL HIGHLIGHTS

Revenue Growth Amid Operational Adjustments

- Interactive Brokers currently shows a low price-to-earnings (P/E) ratio of 19.4, reflecting strong valuation relative to earnings.

- The company achieved a return on capital of 15.5% in 2024, significantly outperforming competitors such as Charles Schwab (8.5%) and Robinhood (5.0%).

- Interactive Brokers reported total revenues of $1.14 billion for Q4 2023, up 16% year-over-year from $980 million in Q4 2022. For the full year 2023, revenues surged to $4.3 billion, a 43% increase from $3 billion in 2022.

- Book value growth reached an impressive 21.57%, demonstrating substantial internal value creation.

- The return on equity stands at 15.5%, above the sector median of 10.41%, highlighting the company’s exceptional profitability and efficient use of shareholders’ equity.

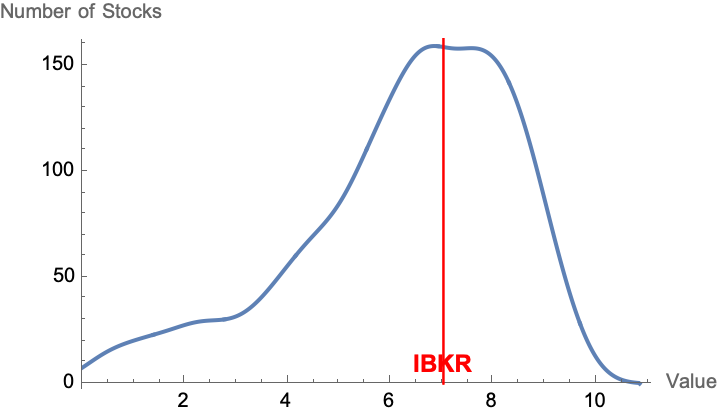

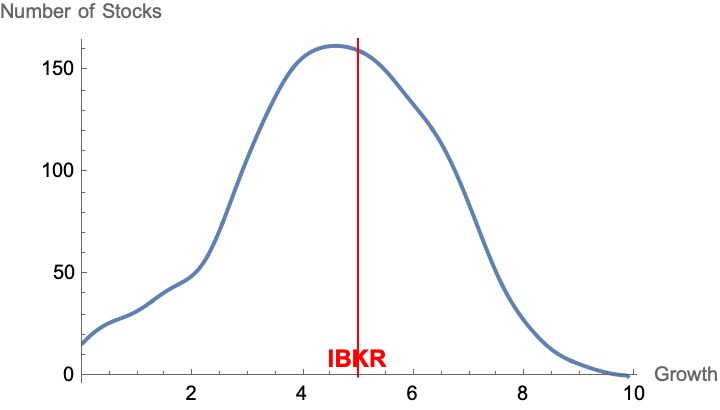

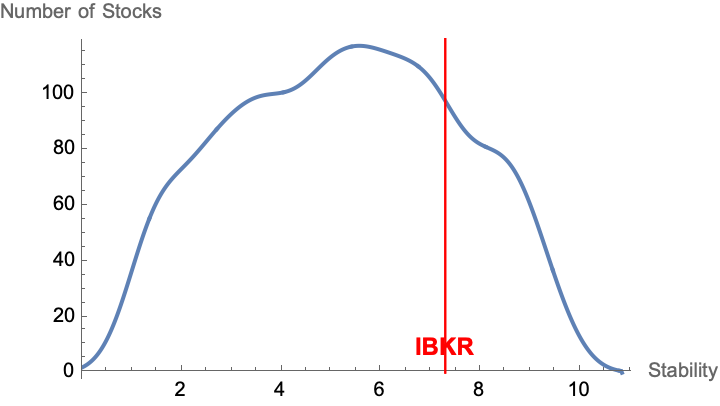

QUANTITATIVE RANKINGS

Fair Value and Growth Rankings amid High Stability

GROWTH STORY

Showing Promising Trajectory with Strong Growth Prospects

Interactive Brokers (IBKR) is on a promising trajectory, driven by a surge in trading activity from investors aged 35 to 44 and impressive Q1 results, including a 72% pretax profit margin. With $6 billion available for acquisitions, IBKR is well-positioned to capitalize on growth opportunities. Despite challenges from competitive pressures and regulatory concerns, the firm’s strong technology and high operating margins support its strong outlook. Analysts project a 20% earnings growth this year, with the stock potentially reaching $160 per share by 2026. The combination of favorable market trends and IBKR’s solid financial health suggest a good future for the company, making it an attractive investment opportunity.

RISK FACTORS

Common Financial Industry Risks Plus Tech/Ops Risk

- Regulatory Changes: Potential adverse changes in regulations, especially concerning payment for order flow, could impact margins and earnings.

- Market Competition: Increased competition and technological advancements in the brokerage industry could affect Interactive Brokers’ market share and profitability

- Interest Rate Fluctuations: Sensitivity to changes in interest rates could impact net interest margins (NIMs) and overall revenue, affecting profitability.

- Operational Risks: Technical glitches, outages, or erroneous orders could harm the firm’s reputation and financial stability.

- Economic Cyclicality: Higher interest rates or rising unemployment could dampen trading activity, influencing overall business performance

MAGNIFINA'S OUTLOOK

A High-Performing Brokerage with a Promising Future

- Strong Positive

- Positive

- Neutral

- Negative

- Strongly Negative

Interactive Brokers has a solid financial health and strategic adaptability in a competitive brokerage landscape. Their impressive revenue growth and solid operating margins points at their market leadership. The firm’s commitment to technology and innovation, exemplified by its sophisticated trading platforms and global reach, strengthens its competitive edge. However, regulatory changes, heightened market competition, and interest rate fluctuations pose some risks. Despite the inherent industry risks, Interactive Brokers remains a strong investment candidate with promising long-term prospects.

Disclosure: Some of Magnifina’s clients (including the publisher) hold a position in this stock at the time of publication.