High-growth tech companies are increasingly using stock-based compensation to attract, retain, and motivate top talent. While this form of compensation can provide significant wealth over time, it also presents unique challenges that employees must navigate carefully. In this article, we’ll explore three of the most significant challenges facing employees with stock-based compensation: illiquidity, concentration, and taxable unrealized gains. By understanding and mitigating these challenges, employees can make the most of their stock-based compensation and achieve their long-term financial goals.

Challenge 1: Illiquidity

Illiquidity refers to the difficulty of converting shares of private companies into cash, as they are not readily tradable on exchanges. Unlike publicly traded stocks, which are bought and sold easily, private stock shares may even be restricted by “lock up” provisions. This lack of liquidity makes it extremely difficult for employees to access the value of their stock-based compensation when they want.

The impact of illiquidity on financial planning and portfolio management is significant. Employees with a substantial portion of their net worth tied up in illiquid stock may find it challenging to fund personal financial goals, such as buying a home, paying for education, or saving for retirement. Additionally, illiquidity can make it difficult to balance a portfolio or adjust investment strategies in response to changing market conditions.

Private Secondary Markets

To access market liquidity, employees with stock-based compensation could consider selling their shares privately. Secondary markets have emerged as another option for employees seeking liquidity for their stock-based compensation. These markets allow employees to sell their shares to investors, providing a way to access the value of their stock without waiting for an IPO or acquisition. However, secondary markets come with their own set of challenges and risks.

Examples of exchanges for pre-IPO shares:

Transactions on secondary markets may be subject to restrictions imposed by the issuing company, such as the right of first refusal or limitations on who can buy the shares. Additionally, valuation on secondary markets is complex, as the stock is not publicly tradable and may incorporate discounts for illiquidity or other factors. Employees considering secondary markets should research the platform, understand the transaction terms, and consult an investment advisor to assess the potential risks and benefits.

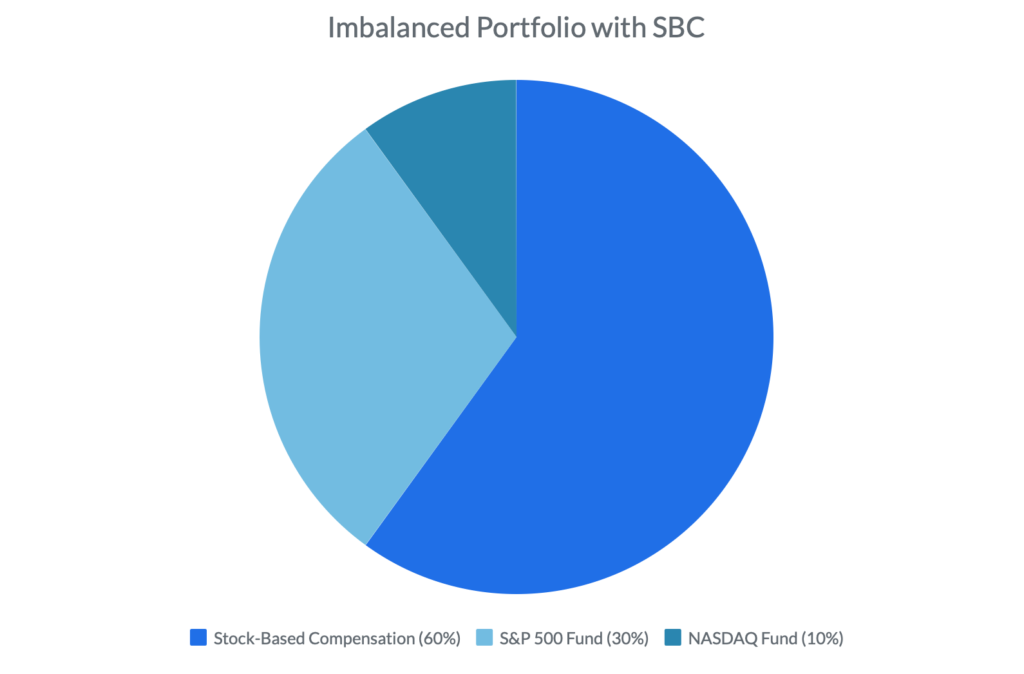

Challenge 2: Concentration

Concentration risk arises when a significant portion of an employee’s wealth is tied to their employer’s stock, leading to overexposure to a single company and industry. The dangers of over-exposure are significant, because if the company faces financial troubles, the employee could lose both their job and a substantial portion of their investments.

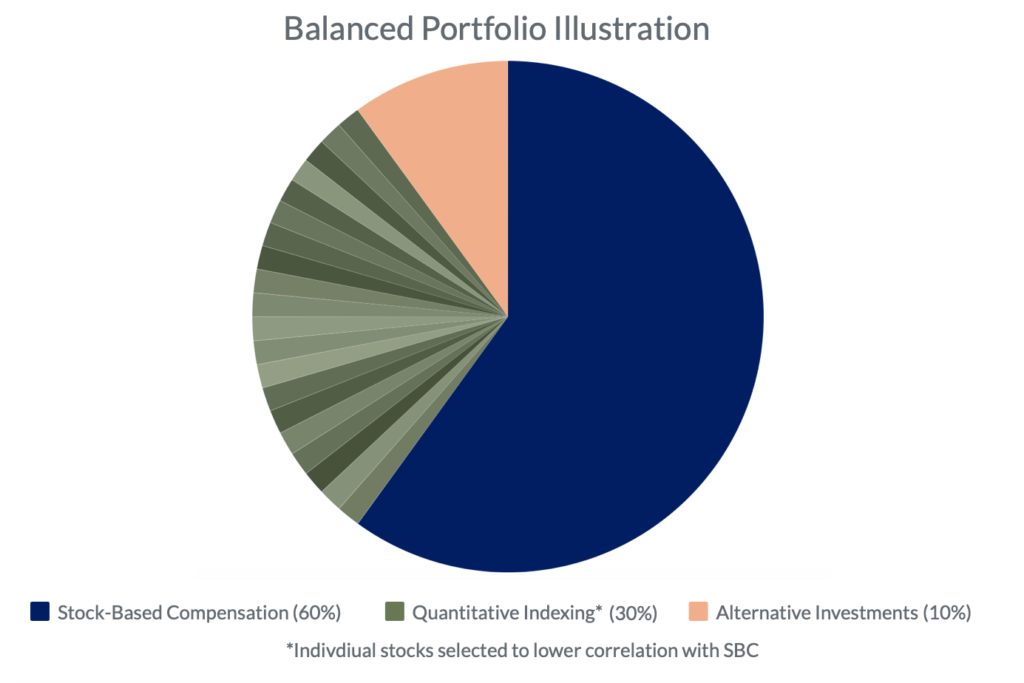

To manage concentration risk, employees must be strategic about how they invest their liquid savings. For example, a tech industry employee purchasing an index fund may unknowingly increase their exposure to their own company and sector. Instead, employees should consider building portfolios that actively diversify away from their employer’s industry, choosing companies with low correlation to their stock. An employee at a tech company should emphasize sectors like healthcare, consumer staples, or utilities while underweighting or excluding technology stocks entirely.

However, diversifying a concentrated position in employer stock can be challenging. Working with an investment advisor can be essential to developing a personalized plan that considers unique circumstances, risk tolerance, and financial goals. An advisor can help navigate the complexities of diversifying concentrated stock positions while considering tax implications, liquidity needs, and long-term financial objectives.

Challenge 3: Tax Complexities

Stock-based compensation creates a maze of tax decisions that can dramatically impact your wealth. Different types of equity compensation each have unique tax treatments, timing rules, and potential pitfalls. Alternative Minimum Tax implications, disqualifying dispositions, 83(b) elections, and optimal exercise timing are just a few of the complexities that can cost thousands if handled incorrectly.

Many employees discover these intricacies too late, often after making expensive mistakes. The tax code around equity compensation changes frequently, and strategies that worked in previous years may no longer be optimal. Working with specialists who understand these nuances is essential for navigating this complex landscape and maximizing your after-tax wealth.

Conclusion: Navigating your Stock-Based Compensation

Stock-based compensation can be a valuable tool for attracting and retaining talented staff, but it also presents unique challenges that employees must navigate carefully. Illiquidity, concentration risk, and taxable unrealized gains are three of the most significant challenges facing employees with stock-based compensation.

At Magnifina, our team of experienced professionals understands the complex challenges facing employees with stock-based compensation. We’ve developed a Quantitative Indexing strategy to address the challenges of liquidating stock-based compensation. Our team works closely with our clients to develop personalized financial plans that help them make the most of their compensation while navigating the risks and challenges involved.

If you’re an employee with stock-based compensation, don’t wait to start planning for your financial future. Contact us today to schedule a consultation and learn how we can help you achieve your long-term financial goals